Consolidation, Capital, and the Climb: Tracking U.S. Cannabis M&A and Investment Trends

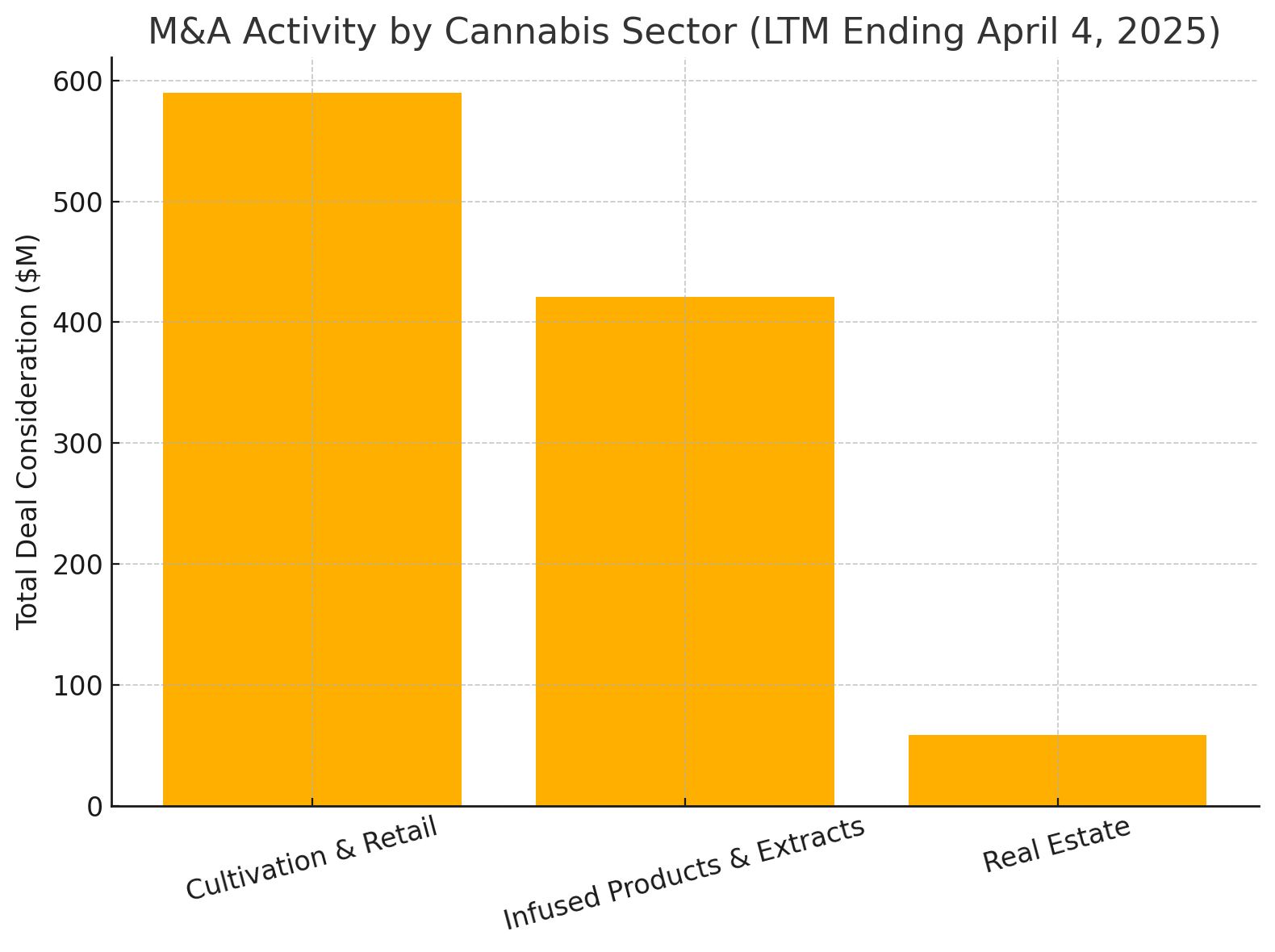

NEW YORK –The U.S. cannabis industry has experienced major shifts in merger and acquisition (M&A) activity over the past year, reflecting broader trends of consolidation and strategic realignment. According to Viridian Capital Advisors, the Cultivation & Retail sector led all others with $589.9 million in total deal consideration for the last twelve months ending April 4, 2025.

This high level of activity underscores the ongoing wave of intra-state roll-ups by leading Single-State Operators (SSOs), a move toward greater scale and operational efficiency.

The Infused Products & Extracts sector ranked second with $421.1 million in M&A consideration. This trend highlights the growing importance of branded products, particularly those derived from hemp, as companies seek to differentiate themselves in a competitive consumer market.

Coming in third, the Real Estate sector accounted for $58.9 million in deal value, reflecting the industry’s continued reliance on sale-leaseback strategies to free up capital while retaining operational control.

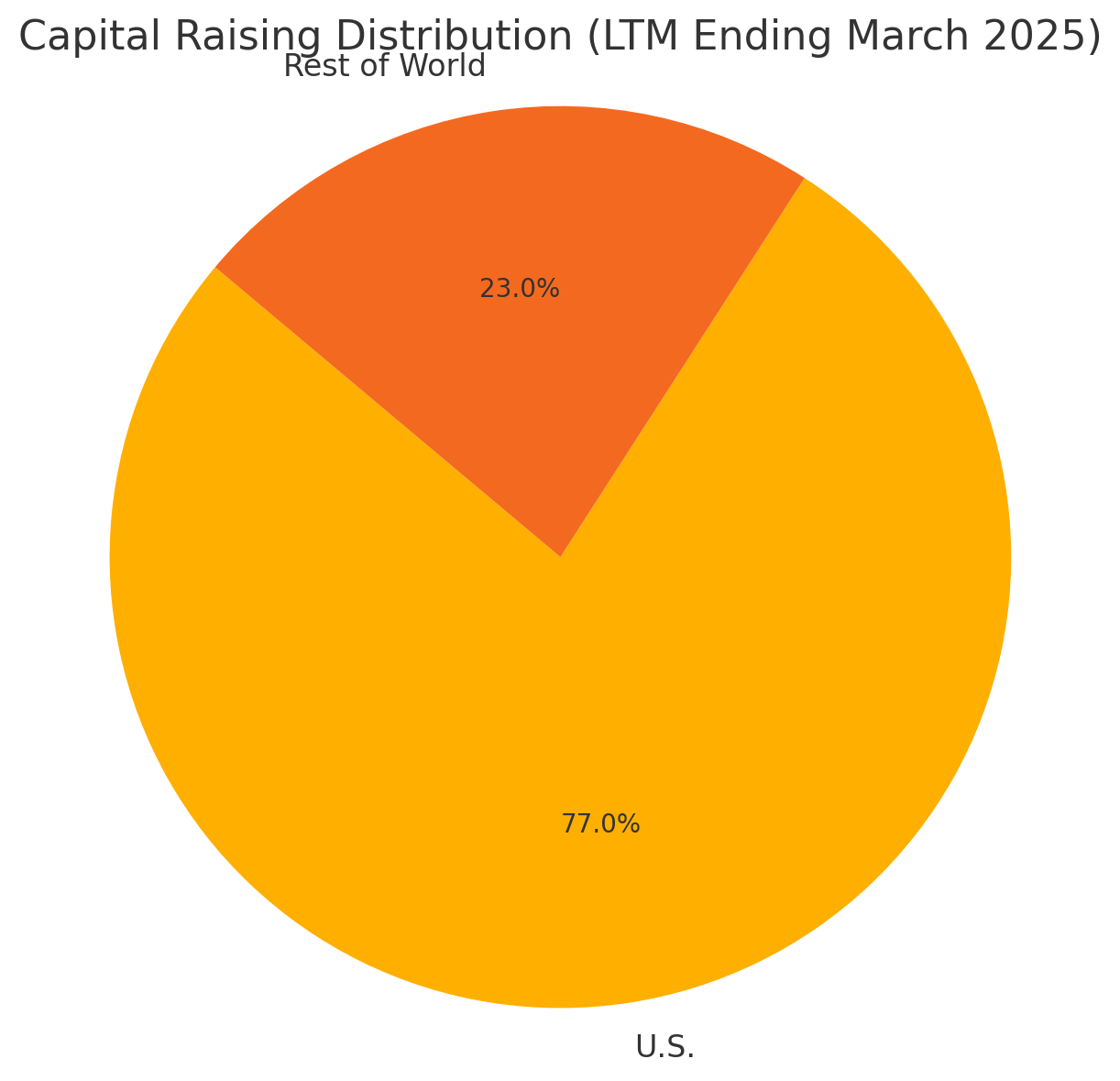

Beyond M&A, capital raising surged, signaling renewed investor confidence. Global cannabis capital raises reached $2.3 billion for the twelve months ending March 2025—a 46% increase from the prior year. Notably, U.S. companies captured 77% of that total, up from 51% a year earlier.

The Cultivation & Retail sector once again dominated capital inflows, raising $1.44 billion—a 76% year-over-year increase. This was fueled by significant debt refinancing transactions by leading multi-state operators (MSOs), as well as a major private equity raise in the cultivation space.

Debt financing has clearly become the primary method for raising capital. Cannabis companies sold $4.3 billion in debt over the past two years, reflecting a shift away from equity as investors grow more cautious. While this provides much-needed liquidity, it also adds refinancing risk, especially as debt maturities begin to stack up in 2025 and 2026.

Market consolidation is also reshaping the landscape. The top 20 cannabis brands have increased their collective market share from 26% in 2020 to nearly 35% in 2023. If this trend continues, the cannabis industry could mirror more mature sectors like alcohol or CPG, where a few dominant players control the majority of sales.

Looking ahead, the potential federal rescheduling of cannabis to Schedule III could unlock institutional capital and further accelerate consolidation. In this environment, larger, well-capitalized operators are best positioned to thrive, while smaller, undifferentiated firms may struggle to compete.

Altogether, the trends in M&A, capital raising, and brand concentration reflect a cannabis industry that is maturing rapidly. Operators who can scale smartly, manage capital wisely, and build lasting brands are poised to lead as the industry prepares for its next phase of growth.

Referenced Sources:

-

Viridian Capital Advisors, Cannabis Deal Tracker

-

Green Market Report: “Debt Undergirding Most Cannabis Capital Raises in Recent Years”

-

Green Market Report: “Report: Cannabis Capital Raises, M&A Both Down Significantly Year Over Year”