Cannabis MSOs Face High-Stakes Tax Dilemma as Rescheduling Decision Looms Under Trump

As Trump’s administration weighs reclassifying Cannabis to Schedule III, Cannabis giants continue to contend with hefty uncertain tax liabilities under IRS Section 280E, a rule that has long hampered their financial flexibility. A recent report from Viridian Capital Advisors estimates these “Uncertain Tax Liabilities” (UTLs) at approximately $2.3 billion across key industry players, highlighting a financial strain that could reshape balance sheets as regulatory changes are considered.

To mitigate the impact of 280E, licensed Cannabis businesses have strategically reclassified expenses into cost of goods sold (COGS), leveraging vertical integration, along with most depreciation and interest, to categorize cultivation and production costs as deductible. Some have even allocated portions of senior management expenses to these areas, claiming they support production activities. Despite these efforts, effective tax rates remain high and erratic, prompting many multi-state operators (MSOs) to rely on legal opinions that they might evade these taxes. They record the liabilities on income statements but defer payments, labeling them as long-term UTLs.

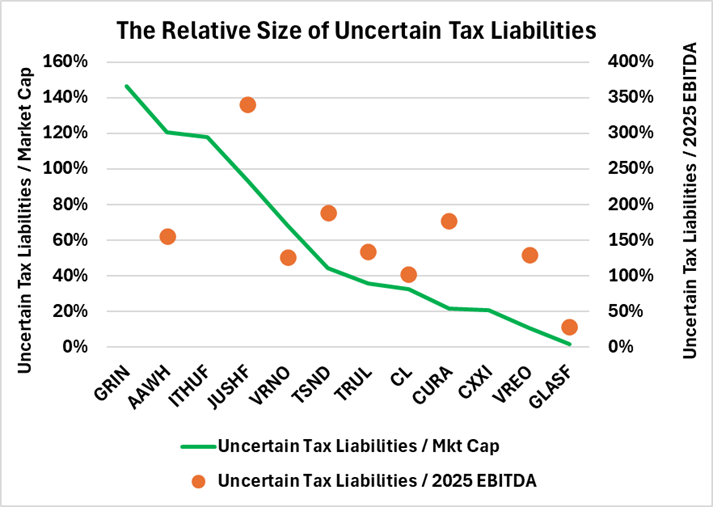

Viridian’s analysis measured these UTLs against market caps and 2025 EBITDA forecasts, revealing stark ratios. Grown Rogue, Ascend Wellness, and iAnthus Capital Holdings had UTLs surpassing their market values, with Jushi Holdings at 94%. Against 2025 EBITDA estimates, Ascend, Jushi, Verano Holdings, TerrAscend, Trulieve Cannabis, Cresco Labs, Curaleaf Holdings, and Vireo Health exceeded 100%, led by Jushi at 341%, TerrAscend at 189%, and Curaleaf at 178%.

Financially, these obligations act like hidden debt, potentially squeezing cash reserves if enforced, or boosting equity if forgiven. Yet, with rescheduling in play, they could represent untapped value, enhancing profitability and attracting capital once resolved.

Trump confirmed this week that his team is reviewing Cannabis classification, signaling potential shifts after months of pause since January. A move to Schedule III would likely halt new 280E accruals post-effective date, though existing liabilities might persist for audits, settlements, or statute lapses. Accounting bodies have pushed for full-year relief in the transition period, but retroactive wipes seem improbable without IRS or congressional backing. As of May 2025, the IRS affirmed 280E’s ongoing application, deeming Cannabis a Schedule I substance. Some firms are preemptively filing non-280E returns, a tactic drawing IRS scrutiny and warnings against premature refunds.

Negotiations offer a path forward, as seen in StateHouse Holdings’ 2022 agreement to pay $5.8 million over time on a $22.1 million assessment—an IRS pragmatic adjustment to the company’s constraints. Viridian factors UTLs as incremental debt in credit assessments but acknowledges reductions for firms demonstrating payment hardships.

These enduring liabilities highlight a critical juncture:

With Trump’s deliberations fueling optimism, any delay prolongs fiscal strain, testing operators’ resilience while promising sector-wide relief if action follows. In this limbo, strategic tax planning remains essential to safeguard against enforcement while positioning for potential regulatory breakthroughs.

Source: Viridian Capital Advisors