Trump Video Fuels Cannabis Stock Surge, Yet Analysts Question Depth of Policy Shift

LOS ANGELES – A recent video posted by President Donald Trump on Truth Social, touting support for CBD products under the Farm Bill, triggered a sharp but fleeting uptick in valuations for major multi-state Cannabis operators, according to a fresh analysis from Viridian Capital Advisors. The post, which highlights federal reimbursement for elder-focused CBD and makes only a cursory nod to medical Cannabis, has left investors parsing its implications for broader rescheduling efforts amid a year of regulatory whiplash.

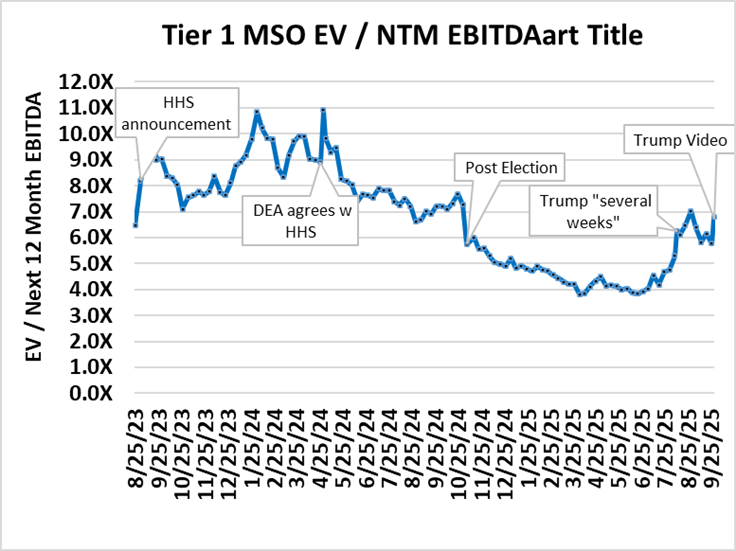

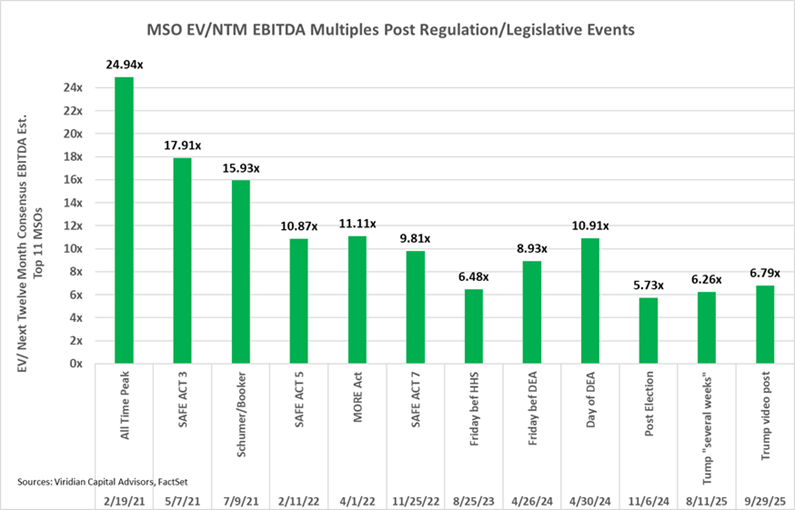

Viridian’s review tracks EBITDA multiples for six leading MSOs [Curaleaf Holdings, Green Thumb Industries, Trulieve Cannabis, Verano Holdings, Cresco Labs, and TerrAscend] from late August 2023 through September 29, 2025.

The period captures a stark trajectory – a steep decline following the DEA’s October 2024 nod to the HHS rescheduling recommendation, exacerbated by the November election’s dual blows of Trump’s victory and Florida’s rejection of adult-use legalization. Multiples bottomed out at levels unseen since before the initial HHS review, reflecting dashed hopes in a market that had banked heavily on Florida’s ballot measure.

A mid-July 2025 wave of insider tweets hinting at White House momentum reversed course, lifting multiples nearly 80% by early August. Trump’s subsequent pledge of a rescheduling call “in several weeks” added fuel, though three weeks of quiet saw values slip from 7.0x to 5.8x EBITDA.

From a financial standpoint, these swings underscore the sector’s acute sensitivity to policy noise, but the numbers also reveal a tempered opportunity. At current levels [post-video hype] the aggregate multiple sits around 6.5x, well below the historical average for these MSOs outside of the late-2024 trough and the first half of 2025.

That compression suggests the market has baked in ample skepticism, capping near-term downside from further delays. On the flip side, any concrete step forward [say, a formal rescheduling rule] could unlock 30-50% upside, based on peer multiples in adjacent regulated industries like tobacco or alcohol. Cash flows for these operators remain solid, with consensus EBITDA growth projected at 15-20% annually through 2026, assuming steady state-level expansions. The risk, of course, lies in prolonged limbo: lasting uncertainty could test balance sheets already strained by high interest costs and tax burdens under Section 280E.

The video, repurposed from external footage, feels more like opportunistic optics than a policy blueprint. It sidesteps recreational Cannabis entirely, raising doubts about Trump’s commitment to full-spectrum reform despite campaign rhetoric. Legal experts, including those at Dentons, maintain that Schedule III classification targets the plant itself, not its uses, but political pragmatism could carve exceptions.

For the Cannabis industry, this episode replays a familiar script: headlines move markets faster than hearings. However, true momentum would demand more than borrowed clips; perhaps a direct embrace of recreational markets to match the enthusiasm of past bipartisan pairings like Schumer and Booker. Investors, meanwhile, hold positions in a valuation trough that promises reward for patience, if not blind faith.

Source: Viridian Capital Advisors