GreenWave Advisors Urges Elected Officials to “Put American Cannabis First”

NEW YORK – In 1996, Medical Marijuana was legalized in California during the Clinton Administration. Since the “Colorado Experiment” in 2014, when the nation’s first recreational use market was implemented, the Federal Government has maintained its prohibitive legal status of Marijuana. Still, the pressures brought to bear by many state statutes that have locally decriminalized and regulated it have gradually encouraged business development. Medical Marijuana is now legal in 39 states, 24 of which permit recreational use.

The progression of state markets has led to a ~ $40 billion industry (estimated by year-end) that could reach well over $100 billion at maturity; capital expenditures are in the billions of dollars. The materialized economic benefits can no longer be ignored; however, the window of opportunity for continued growth is at risk. Capital remains scarce, and the ability to continue as a going concern is a real issue for many cannabis enterprises. Most operators cannot generate sufficient operating cash flow because of the ongoing headwinds of federal prohibition and the proliferation of hemp-derived intoxicants. The harsh reality is that most operators have had to raise capital to satisfy the punitive tax burden associated with 280E.

The Cannabis Industry embraces American entrepreneurship’s true spirit, which is the unrelenting willingness to take calculated risks and adapt to changing circumstances. The dichotomy between state and federal laws contradicts the overwhelming majority of Americans who support the end of federal prohibition. Unfortunately, instances of political interference continue to impede meaningful progress.

As just one example, former AG Barr directed the Department of Justice to conduct antitrust reviews of several proposed cannabis mergers costing operators much time and money. One DoJ official even testified at a Congressional hearing that “the rationale for doing so centered not on an antitrust analysis, but because [Barr] did not like the nature of their underlying business.” And we know there have been other instances over the years.

The global cannabis market is developing at a steady pace and, by some estimates, will exceed $400B. America has an opportunity to be the world leader—we have the talent—but its destiny remains in the hands of our elected officials. Putting American cannabis first will facilitate and arguably increase the economic benefits of increased tax revenues from domestic sales and exports, job growth, and investment opportunities.

Economic Growth Drivers

State Tax Revenues. The sales tax rates on cannabis revenues vary by state. If we assume an average of 20%, $20B/year can be realized based upon a market size of $100B (at maturity).

Federal Excise Tax Revenues of ~ $8B/year to replace 280E. Over the years, we have tracked the 280E tax burden and reported revenues for the publicly traded MSOs. We estimate that 280E as a percentage of gross sales is approximately 8%, which could set a parameter for a federal excise tax. Assuming a $100B market size at maturity equates to roughly $8B annually in excise tax collections.

This calculation represents a much lower excise tax rate than other federal reform efforts sponsored by Democrats. Specifically, Senator Chuck Schumer’s Cannabis Administration and Opportunity Act (CAOA) proposes levying a 25% federal cannabis sales tax on any products produced in or imported into the US (the fifth year after re-scheduling).

An end to banking/lending restrictions and the “de-bank.” Federally chartered and insured financial institutions have generally refrained from transacting business with any known entity that derives its revenues from cannabis-related activities.

As the industry continues to evolve, the clear and present risk of transacting business in “cash only” continues to supervene. Many businesses are not able to accept debit or credit cards, write checks, or make (or receive) payments electronically. These limitations plague entities that “touch the plant” and ancillary businesses and service providers.

Over the years, several financial institutions have de-banked state-licensed cannabis businesses, and in many cases, individuals gainfully employed or associated with the cannabis industry. Furthermore, cannabis companies remain shut out from SBA (Small Business Administration) funding, which was particularly problematic during the COVID pandemic, which put disproportionate pressure on many cannabis businesses.

The Office of the Comptroller of the Currency (OCC) recently reaffirmed that a range of cryptocurrency activities are permissible in the federal banking system. This begs the question of why the cannabis industry remains, for all intents and purposes, shut out.

Ability to list shares on a major U.S. exchange. American Cannabis operators cannot list shares on either the NYSE or the NASDAQ because of federal illegality, a headwind that Canadian LPs can avoid. American cannabis is disadvantaged because federally legal businesses (and foreign companies listed on a US exchange) cannot readily deploy investment dollars into a US cannabis business without the risk of a de-listing. For example, Constellation Brands (US Company) invested ~$4B in Canadian LP Canopy Growth.

The industry’s financial situation remains precarious. US publicly traded cannabis operators are essentially forced to list north of the border on the CSE, which lacks liquidity and is one of many reasons that keep meaningful investment dollars on the sidelines.

Cannabis as an Exchange Traded Agricultural Commodity. Capital markets include a regulated commodity exchange for trading physical resources like iron, wheat, gold, etc., and derivatives to hedge against price fluctuations. Cannabis is an agricultural commodity but, due to federal illegality, is excluded from trading on a regulated commodities exchange. Businesses across many industries use derivate products such as futures and options to hedge exposure to fluctuations in commodity prices (as well as interest rates and foreign exchange). Successful hedging outcomes help abate input cost spikes in the short term, which reduces the volatility in reported margins.

Small Businesses Will Create At Least 1 Million New Jobs Annually If Trump’s Tax Cuts Are Made Permanent. This estimate does not include cannabis-related employment, which currently stands at ~500K.

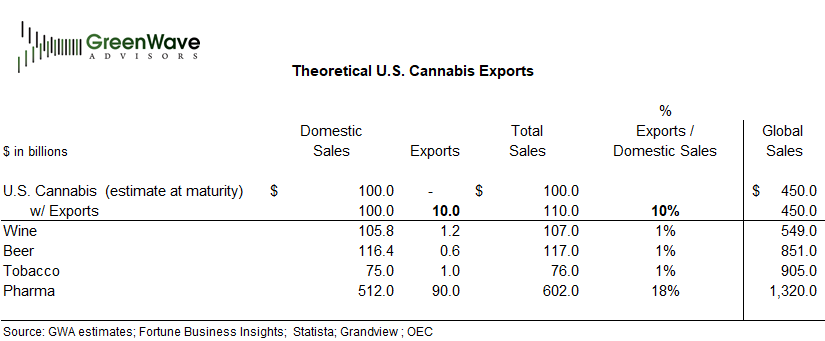

America First in Exports. Several other countries are EXPORTING Federally legal medical Cannabis products to meet the growing global demand. Why not America? American exports of Beer, Wine, Tobacco, and Pharma are illustrated in the following table. The American cannabis market could increase by $10B+, leading to even MORE AMERICAN JOBS and more American tax receipts. Currently, Canada leads in exports because it has ended federal prohibition. There is no reason why American can’t take the lead.

Medical Marijuana will recalibrate upon rescheduling. A significant increase in clinical research and drug development from academic institutions and pharmaceutical companies, further expanding the opportunity for cannabinoid-focused pharmaceutical development.

Cost Reductions

$55M+ annual saving from the release of ~1,500 that remain in custody for simple marijuana possession. It is difficult to precisely quantify the entire scope of opportunity costs of marijuana prohibition. Still, the most transparent effects stemming from the effective criminalization after the Marijuana Tax Act of 1937 include prison costs. We estimate that federal prison costs exceed about $55 million/year, which does not include other law enforcement expenses such as court costs, local jail time, etc. – the total expense to taxpayers is therefore higher. There are ~1,500 that remain in custody at a cost of ~$100/day.

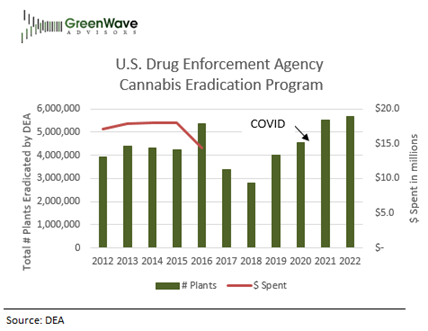

$18M+ annual savings with the elimination of the DEA plant eradication program The Drug Enforcement Agency (DEA) Cannabis Eradication Program appears irrelevant and an inefficient use of tax dollars, mainly because many states run similar programs that are independent of the DEA. These funds are better spent on getting Fentanyl off our streets. Total program expenditures were available only from 2012-2016 (red line on chart) – about $18M/year but dipped in 2016. DEA has not published its 2023 report (typically available in May).

Marijuana vs Fentanyl. US Customs and Border Patrol reports Marijuana as the #1 drug confiscated at the US border in terms of quantity and # of incidents. Federal legalization and reform – which FINALLY catches up with the will of the American people – would further disrupt the economics of the Mexican cartel cross-border trade. American law enforcement resources are better served by stopping Fentanyl from entering the US – it kills, but Marijuana DOES NOT. Every dollar out of the hands of the cartels is money that the US Government could redirect to a legal and regulated US market and tax.

Matthew (Matt) Karnes is the founder of GreenWave Advisors (2014) which provides financial research, analysis, due diligence and other consulting services for the cannabis industry. Matt also founded GreenWave Capital Partners (2023), an affiliate partner of Stonehaven, LLC, a SEC Registered Broker Dealer and FINRA Member Firm. Stonehaven provides services to institutions with private placements, PIPE transactions, secondary market block trades, buy-side and sell-side and merger and acquisitions.

Matt has over 30 years of diverse finance and accounting experience. Prior to founding GreenWave Advisors LLC, Matt worked in equity research focusing on the Radio Broadcasting and Cable Television industries for First Union Securities. Matt also covered Satellite Communication at SG Cowen and in addition, worked with the top ranked Consumer Internet analyst at Bear Stearns & Co – this team was consistently recognized by the Institutional Investor’s “All America Research Team”. As a sellside equity analyst, Matt authored and co-authored numerous emerging industry research reports including such names as Google, Sirius, XM Satellite Radio, DIRECTV and EchoStar Communications.

Matt was also Principal and Senior Equity Analyst at Bull Path Capital Management, a New York City based hedge fund, where he was responsible for investment strategies of emerging technologies primarily within the Technology, Media and Telecom sectors. Prior to his career on Wall Street, Matt held various finance and accounting positions at Price Waterhouse Coopers and Deloitte as well as at Texaco Inc. where he worked throughout the U.S., Europe, The Caribbean and Asia. Additionally at Chase, Matt was responsible for implementing the bank’s corporate accounting policies on commodity, interest rate and foreign currency derivative products. Matt graduated from Fordham University with an MBA in finance and earned a B.S. Business Administration with a double major in accounting and finance from Miami University (OH). Matt is also a Certified Public Accountant.