NY Cannabis Market Posts Record August Sales, OCM Reports

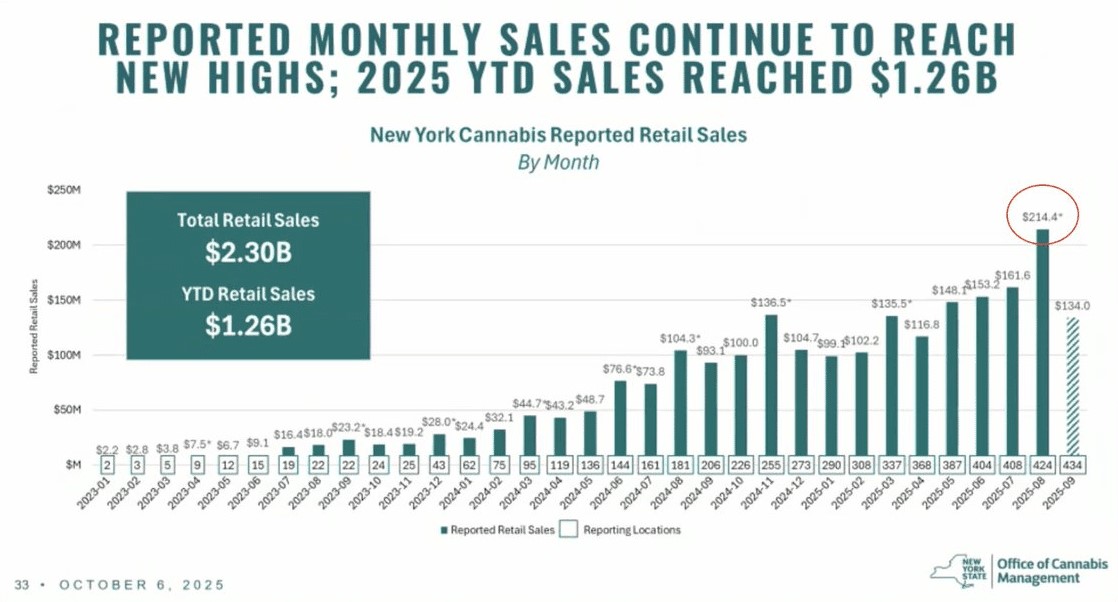

NEW YORK – New York dispensaries rang up $214.4 million in legal Cannabis sales in August, the highest total since the program’s start nearly three years ago, according to the state’s Office of Cannabis Management.

The August figure tops July’s $161.6 million by 33% and June’s $153.2 million by 40%. It also doubles the $104.3 million recorded in August 2024, a sign of the sector’s quick ramp-up as more stores come online and buyers settle into regular habits.

Year-to-date sales stand at $1.26 billion, more than double the pace of last year at this point. That puts the state on course to beat its official 2025 target of $1.8 billion, and possibly hit $2.5 billion or more if the upward trend continues through the holidays.

“We could be at $3 billion watch by the end of the year,” said Kevin Brennan, the OCM’s deputy director of analytics, during a recent board meeting. He credited the surge to the steady addition of licensed outlets [now numbering 464 statewide] and steady buyer interest across flower, vapes, and edibles.

The numbers reflect a market coming into its own. Since the Marijuana Regulation and Taxation Act took effect in March 2021, with the first retail license issued in December 2022, New York has built one of the country’s stricter regimes: adults 21 and older may carry up to three ounces of flower or 24 grams of concentrates, with taxes funding equity programs and community reinvestment.

Still, the path has included bumps. Earlier this year, the OCM flagged location issues for over 150 retailers, prompting lawsuits from operators who say the rules upend their plans. Sales per store, while up lately, remain below what some analysts project for a mature market that could support 1,700 outlets long-term.

To gauge the trajectory, consider this: August’s 106% year-over-year jump outstrips national averages, where established states like Colorado and California see single-digit gains. If New York sustains 25% monthly growth from here, full-year revenue could top $2.8 billion; well above forecasts and a boon for tax coffers projected at $500 million annually once stabilized.

These figures signal a turning point for operators and investors. With supply chains firming up and consumer spending resilient, New York’s Cannabis sector stands ready to claim a bigger share of the $30 billion U.S. total. The real test will come in sustaining that momentum against regulatory headwinds and illicit competition, but the data points to a market built for the long haul.