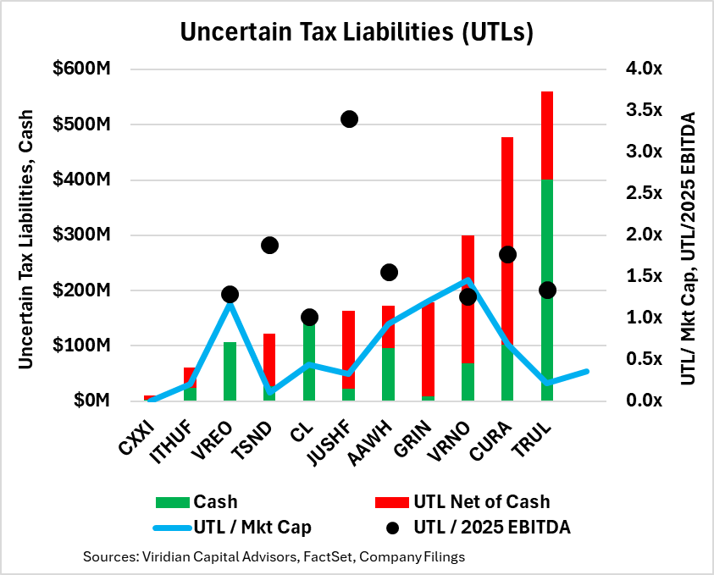

MSOs Confront Billions in Uncertain Tax Liabilities

LOS ANGELES – U.S. Cannabis operators continue to navigate the constraints of IRS Section 280E, which bars deductions for standard business expenses and drives up effective tax rates. Major multi-state Cannabis operators (MSOs) have leaned on legal opinions to expense these taxes without immediate payment, instead accruing them as uncertain tax liabilities (UTLs) on their balance sheets. According to a recent analysis by Viridian Capital Advisors, these accrued amounts across key players total around $2.3 billion [!].

The IRS has maintained a firm stance, insisting on full compliance with 280E and rejecting any grounds for deferral. This position came into sharper focus in June when the agency issued a federal tax lien against MariMed for alleged unpaid assessments. Viridian’s data highlights the scale: only Vireo and Cresco hold enough cash to cover their UTLs outright. For others, these liabilities often eclipse available liquidity, with red bars in Viridian’s chart showing net UTLs after cash reserves.

From a financial perspective, these UTLs pose risks comparable to traditional debt. At least three firms (Grown Rogue, Ascend, and IAnthus) carry UTLs exceeding their market capitalizations, while Jushi’s stands at 94%. Relative to projected 2025 EBITDA, all analyzed companies with estimates show UTLs over 100%, led by Jushi at 341%, TerrAscend at 189%, and Curaleaf at 178%. This suggests that settling these could strain operations, potentially forcing asset sales or restructurings if demands intensify.

Rescheduling to Schedule III would likely halt new accruals post-effective date, but existing UTLs would persist, open to audits, negotiations, or expiration under statutes of limitations. The American Institute of CPAs has pushed for full-year relief in the rescheduling year, though retroactive forgiveness for prior periods seems improbable without clear IRS or congressional action.

Precedents exist for reductions, as seen in StateHouse’s 2022 deal to pay $5.8 million over a decade on a $22.1 million assessment—a pragmatic IRS concession rather than a formal cut. Still, the agency may press hard in talks, especially for viable firms.

Investors eyeing 2026 debt maturities should factor in UTLs as another cash pressure point, albeit without fixed deadlines. Settlements could shape rescheduling outcomes.

Source: Viridian Capital Advisors