Mid-Cap Cannabis Operators Face Liquidity Pressures Despite Solid Leverage, Viridian Report Finds

LOS ANGELES – Public Cannabis companies with $25-100 million market values are navigating a patchwork of financial strengths and vulnerabilities, according to the latest Weekly Credit Report from Viridian Capital Advisors. It tracks eight U.S.-based cultivation and retail companies, revealing a sector where half the group can cover short-term obligations without fresh capital, but several laggards signal potential funding crunches ahead.

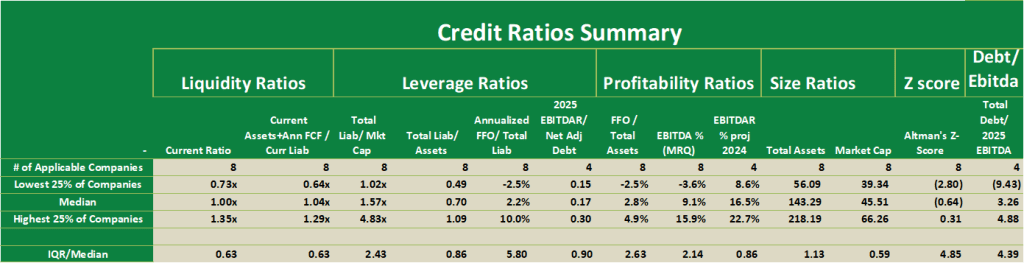

At the median, the free cash flow-adjusted current ratio stands at 1.04x, a figure that suggests more than 50% of these operators hold enough liquid resources [bolstered by cash flows] to meet immediate liabilities without dipping into asset sales or external loans. Yet the bottom quartile paints a starker picture. Ratios as low as 0.73x, flagging four companies (Jushi Holdings, Planet 13 Holdings, Leef Brands, and iAnthus Capital) as particularly exposed. These firms may require bridge financing or operational tweaks to shore up working capital, especially as holiday-season cash burns test retail-heavy models.

Leverage metrics offer some counterbalance. The median total liabilities-to-market-cap ratio clocks in at 1.57x, comfortably shy of Viridian’s 5-times threshold, which often signals inadequate asset coverage for debts. This implies most in the cohort maintain a buffer against market dips, with equity values still outpacing obligations. The bottom 25%, however, includes Jushi and iAnthus, both exceeding that red line and grappling with hefty debt maturities in 2026. For Jushi, the strain is tempered by its foothold in Pennsylvania and Virginia, states primed for adult-use legalization that could unlock revenue streams and ease refinancing talks.

Profitability tells a mixed tale. Median annualized EBITDA-to-total debt sits at 2.2%, with the top quartile boasting double digits, driven by efficient operators squeezing margins from vertical integration. But the low-end dips negative, underscoring how razor-thin tolerances for error persist in a federally restricted market. Size rankings, proxied by total assets and market cap, show medians of $143 million in assets and $45.5 million in capitalization – modest footprints that limit scale advantages but also cap downside in a downturn.

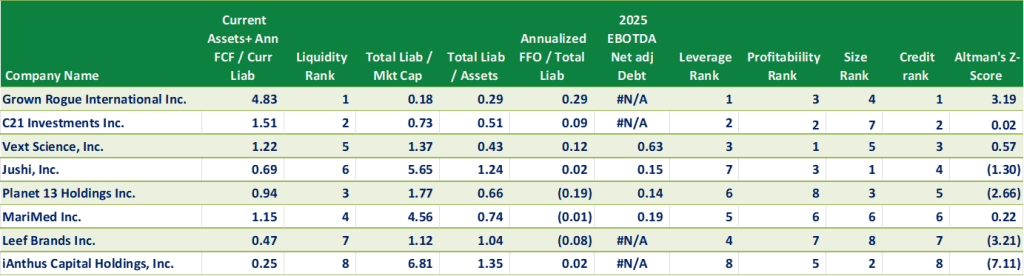

Grown Rogue International emerges as the standout, claiming the top spot in Viridian’s composite credit ranking thanks to unmatched liquidity [a 4.83x current ratio] and leverage profiles. Its metrics suggest a playbook of disciplined cash management and low-debt growth, positioning it as a model for peers chasing stability. On the flip side, iAnthus anchors the bottom, dragged by eighth-place finishes in liquidity and leverage despite a respectable second-place size ranking. Even with larger assets, its debt load overwhelms, highlighting how bulk alone can’t offset execution gaps.

From a financial lens, these snapshots underscore the Cannabis mid-tier’s bifurcated reality: leverage remains a relative bright spot, reflecting post-bust deleveraging efforts, but liquidity woes expose the sector’s addiction to intermittent capital infusions. With federal reform stalled and state expansions uneven, operators below the median line face a 2026 gauntlet where bond markets may demand premiums for perceived risks. Yet for frontrunners like Grown Rogue, this environment rewards prudence, potentially widening the gap between survivors and stragglers.

The takeaway here is clear. In a capital-starved arena, credit health is the line between expansion and contraction. These companies would do well to prioritize cash conversion over growth at any cost, lest 2026’s maturities turn warning lights into full alarms. Investors, take note: the resilient few are building moats, while the rest chase bridges.

Source: Viridian Capital Advisors