Vertical Disintegration – Who Eats Who?

Vertical Disintegration – Who Eats Who?

Young America Capital’s investment bankers Jon Lunsford and Sean Santa have published the first of three articles examining vertical disintegration from the standpoint of those raising private capital for cannabis firms and advising them on mergers and acquisitions.

The term is counterintuitive, they write, especially to those who appreciate the regulatory, legal, and tax reasons that reward vertical integration. However, as legal barriers to institutional investment and interstate commerce fall, vertical integration will become less dominant.

The authors highlight the tradeoffs between activist hedge funds, special situation investors, and other forces feeding on over-performing or under-leveraged firms. The strongest firms can catch the wave themselves, stand pat or maximize shareholder value via sale.

The authors ask how new capital will view vertically integrated cannabis operations and whether they will thrive on vertical integration. They note that some CPG companies do, but there is no single right answer.

Overview

This is the first of three articles assessing vertical disintegration from the standpoint of those raising private capital for cannabis companies and advising them on mergers and acquisitions.

You will hear more about vertical disintegration in the U.S. cannabis industry. The term is counterintuitive, provocative even to industry participants. It’s unconventional, especially to those who appreciate the regulatory, legal and tax reasons that reward vertical integration.

A significant share of the industry’s capitalization was attracted by vertical integration, for logical reasons. In normalized capital markets, market forces will reverse that polarity, for equally logical reasons.

The justifications for vertical integration won’t change overnight, but eventually legal barriers to institutional investment and interstate commerce will fall, and with them the dominance of vertical integration. Such an endgame provides a framework for assessing a vertically integrated company’s strategy as events unfold. But it won’t be simple or easy.

What is a specific company’s endgame? What parts of the supply chain do they concentrate capital on? Are they changing their asset portfolio too soon or too late? Too aggressively or not aggressively enough? How do they create shareholder value and liquidity?

Endgame: Focused Capital

Let’s distinguish between disintegration and disaggregation. Disintegration results in cannibalization and liquidation, while disaggregation results in rationalized operating segments, focused capital allocation, and increased size. There will be a lot of both. Market distress is already breeding aggregators, though they are currently held back by general unavailability of equity capital.

Asset rationalization will accelerate horizontal integration. Vertically integrated companies may achieve the same result through tax efficient M&A activity: 1031 exchanges, spinning off operating segments as market conditions permit and more states make more cannabis business licenses available, etc.

But it’s never as easy as it sounds. What will the private market value of these assets be in this scenario? Outright asset sales may or may not be viable from a tax perspective, and companies with significant 280(e) liabilities may face both technical and real solvency issues pro forma a given disposition (if not sooner).

That gets uncomfortable quickly in the legalization scenario. An involuntary bankruptcy only requires three creditors to file. Sometimes you can discharge tax debt via Chapter 11, sometimes you can’t. If not, the IRS goes to the front of the line for the proceeds of asset sales, which could be painful for lenders relying on collateral.

Some assets will be sold on the cheap while others grow in value as a result.

The industry is already gasping for capital. How could things possibly get worse?

Mass Extinction Event?

The Chicxulub asteroid wiped about three quarters of all species along with all the dinosaurs. Wiping out 75% of existing species is a consensus threshold for a mass extinction event, of which there have been five in total (so far).

Do you think a quarter of today’s cannabis companies long survive the asteroid called descheduling/legalization, or, even worse, the specter of rescheduling? We think the jury is out.

Make no mistake. Increased revenues from legalization will lift many boats in the short term. But the party will be short-lived because of what else it brings.

New predators.

Isn’t More Capital a Good Thing?

Of course. But there are tradeoffs: activist hedge funds, special situation investors, buyout firms, federal bankruptcy protection and the rest of the forces that feed on the underperforming and the over-leveraged (and under-leveraged). They’ll pressure the strong companies as well. Properly positioned companies will either catch the wave themselves, stand pat or maximize shareholder value via sale.

Buy, sell or hold? The riskiest choice is not making one, but what and when will vary by company. And who falls into what category?

How Will New Capital View Vertically Integrated Cannabis Operations?

- General over-investment in cultivation and manufacturing assets, often in suboptimal locations. Indoor grows in intemperate climates when flower of equal or better quality can be grown more cheaply and shipped quickly from states with milder climates. Plants poorly located for interstate commerce.

- Brands that only exist because their parent owns the inputs and the shelf space.

- Retail that undermines optimal merchandising by over-emphasizing house brands.

And they will see exceptions, of course. Which of today’s operators are exceptional?

No One Right Answer

There is a school of thought that some CPG companies thrive on vertical integration. That’s broad at best. IKEA doesn’t make furniture (they have 1,600 suppliers). Phillip Morris doesn’t grow tobacco (though they do manufacture cigarettes). Pappy Van Winkle pays an independent distiller to make and bottle its brand. Starbucks doesn’t grow coffee, but it does process, distribute, and sell it, including through its own retail. Could a Starbucks emerge from any of today’s operators?

Companies that own the entire supply chain must balance the competing interests of each of its operating segments. Alas, those interests naturally conflict. Most urgently they must generate return on investment on all assets. Easier said than done. One part might subsidize another, but that slope can be slippery.

Not A Death Knell for All Operators, Just Most Of Them.

Today’s competitive pressures are mere foreshadowing. Some companies will perform and survive. Many are already distressed, and even the strongest can feel the pressure.

Who survives? Who emerges? Who eats who?

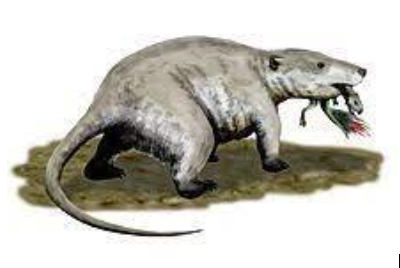

Mammals and Dinosaurs

Dinosaurs dominated their environment. Mammals were small and resembled rodents.

Several fed on dinosaurs, as it happens, likely as scavengers. That sounds about right.

Many asset sales these days are smaller players feeding off chunks of dinosaur meat, primarily retail. Those feeding are smaller, nimble, and more adaptable than large companies.

Who Survives

Mammals had it relatively easy. But they didn’t then face an invasion of apex predators that are interested in existing companies only as bargain snacks.

But how can we identify winners?

- Acceptance. It’s easy to get stuck in the various stages of grief. Who’s moving on? Who’s buying, selling and trading assets in a way that results in capital concentrated where it returns best?

- Adaptability. It’s new game, and a company can’t change the past. But it can make a coherent, realistic plan to get somewhere esle. Where is that place and how does it get there? What are the milestones and what is actionable now?

- Resilience. Sound operating fundamentals and balance sheets. Few, if any, material weaknesses.

- Access to capital. Change takes money.

- Judgment. Does management make the hard calls – at the right time? Do they have the chops to navigate a risky M&A wave?

Who Emerges

Creative destruction is great for a few, but hard on everyone else. Given the regulatory and licensing complexity of cannabis, we think that some existing participants are in the best position to consolidate, whether they do so through existing companies or new ones.

Let’s suppose a hypothetical source of equity for the cannabis industry. Where are the opportunities?

- Vertically integrated companies are able to: disaggregate their supply chain and monetize the elements in a strategy that best concentrates capital on tightly focused opportunities and advantages. In-market scale matters, so it’s a mistake to assume none of the large vertically integrated players takes it to another level.

- Processing, Manufacturing, etc.: The existing industry footprint is based on state lines and in many cases incentives to invest in assets whether the overall market needs them or not. This is a consolidation play, with location a major factor in valuation. Brands can make a case for controlling their own production, but can their profits justify the corresponding massive investment? Some yes, some no.

- Savvy retail operators not beholden to their supply chain: Savvy here includes expertise in real estate, marketing, merchandising, operations and squeezing vendors for concessions in a way that drives gross profits for both parties.

- Cultivation: There is already a lot of blood being spilled here. Cultivation is just farming as far as the mass market is concerned. Will there be enough demand for boutique brands to justify all $30 million grows with high energy and water costs?

- All the connoisseurs are already cannabis consumers, so legalization won’t help the premium category that much. Most indoor grows will serve as many brands as they can practically capture. Many will close.

- And, as flower declines as a percentage, many other product categories will want the cheapest inputs possible.

- This environment will favor outdoor and greenhouse in moderate climate zones with low transportation costs, and a relatively few indoor grows for boutique brands.

- Brands: This is wide open. There is no normal nationwide market. As stores close, shelf space will be devoted by good retail operators to the brands that sell and the brand operators that work with retailers to drive profits with special deals, joint marketing, and attention to shifting customer tastes, including new products and new cannabinoids.

- The smartest brands will abandon owned retail, which will be healthy for both segments. We are already seeing this.

Who Eats Who

The answer is complicated, but the question is simple.

Who will generate the best ROI?