Global Cannabis Market Tightens Amid Surging Demand and Supply Snags

LOS ANGELES – Germany’s medical Cannabis imports jumped more than 400% in H1 2025, pushing the European market into a period of rapid expansion and testing the limits of international supply chains. That surge has drawn heavy exports from Canada and created openings for established players while squeezing margins for others. The Federal Institute for Drugs and Medical Devices in Germany halted new import approvals in September after hitting the annual quota of 122 tons, a move that underscores the tension between patient access and controlled growth.

This boom comes as regulators across Europe refine rules on everything from telemedicine prescriptions to certification standards, aiming to balance innovation with oversight. Updates to Good Agricultural and Collection Practices (GACP) and stricter interpretations of EU Good Manufacturing Practice (EU-GMP) compliance are forcing processors to adapt quickly, often at added cost. In several countries, including the UK and Australia, authorities have limited remote prescribing in an effort to curb perceived overuse, which could slow patient enrollment even as demand rises. Analysts point out that these adjustments, while necessary for quality control, risk fragmenting the market further if not harmonized at the EU level.

A fresh backlog in Portugal illustrates the vulnerabilities. Once a key processing hub for Canadian flower lacking EU-GMP certification, Portugal saw raids on licensed facilities in May that idled over 25 tons of product. The operation, which netted arrests and seized assets worth hundreds of thousands of euros, exposed gaps in enforcement and delayed re-exports to high-demand spots like Germany and the UK. With that inventory now clearing customs, experts anticipate a short-term glut that could accelerate price drops, echoing the consolidation wave that hit Canada’s recreational sector post-legalization. Larger firms with direct EU-GMP capabilities, such as those in Canada, stand to gain by routing shipments straight to end markets, bypassing intermediaries like Portugal.

The Fall 2025 Global Cannabis Report from the Global Cannabis Exchange (GCX), a platform tracking international trades, calls for better production discipline and cross-border coordination to steady prices and flows. “Without it, we’re looking at cycles of boom and bust that favor the deep-pocketed over the agile,” the report states, based on data from over 500 transactions in the past quarter. GCX data shows bulk flower prices in Europe down 15-20% year-to-date, a compression driven by oversupply from new entrants in Colombia and Morocco alongside steady Canadian volumes.

On the corporate front, mergers and acquisitions offer a counterweight to these pressures, though patterns vary by region. Canada’s recreational market remains fragmented, with the top five producers like Organigram, Tilray, Village Farms, Auxly, Decibel, and Cronos controlling just 34.9% of sales in Q1 2025. Canopy Growth, an early leader, now holds only 3.2%, a reminder of how quickly advantages erode without scale.

In the U.S., federal barriers and high debt loads have stalled big deals, limiting activity to regional roll-ups despite state-level sales expected to top $40 billion in 2025 revenues.

Europe, by contrast, is seeing its first cross-continental moves. Canadian retailer High Tide sealed a €26.4 million deal in September for a 51% stake in Remexian Pharma, a German wholesaler with EU Good Distribution Practice certification. The acquisition gives High Tide a foothold in Germany’s €670 million medical sector, projected to double by 2029, and signals a broader trend of North American capital flowing eastward. GCX forecasts a pickup in such activity starting next year, as valuations stabilize and regulatory clarity improves, potentially reshaping supply routes.

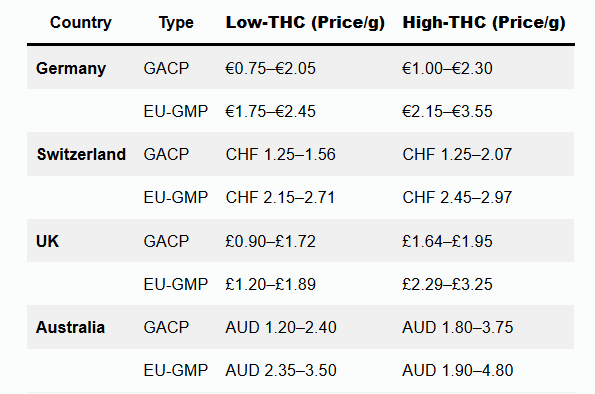

Pricing tells a similar story of strain and selectivity. Demand for potent strains holds firm, but bulk volumes face downward pressure.

These ranges, drawn from GCX transaction logs, highlight a bifurcation: premium certified product retains value for pharmaceuticals, while commodity grades compete on volume. A simple regression on quarterly data suggests that for every 10% import increase, average prices dip 5-7%, a dynamic that could erode profitability for mid-tier exporters unless offset by volume gains.

Critically, this setup rewards efficiency over volume alone. Well-funded operators can absorb certification costs and scale direct shipments, but smaller processors risk being sidelined in a market where margins already hover at 20-30%. The GCX report urges standardized tracking [perhaps via blockchain pilots] to cut fraud and delays, though implementation would demand buy-in from disparate regulators.

As 2025 closes, the global trade stands at a crossroads: explosive growth in patient numbers, now exceeding 700,000 in Germany alone, against the drag of uneven rules and logistics hiccups. For industry veterans, the path forward lies in pragmatic alliances [shared certification hubs, joint lobbying for EU-wide standards] that turn friction into foundation. Without them, the next surge could leave more winners than the system can sustain, but with [!] them, Cannabis commerce might finally match its therapeutic promise with economic muscle. Highly Capitalized Network-HCN will track these shifts closely as markets recalibrate.