Germany’s Medical Cannabis Imports Hit Record in Q2 2025, Sparking Debate Over Misuse

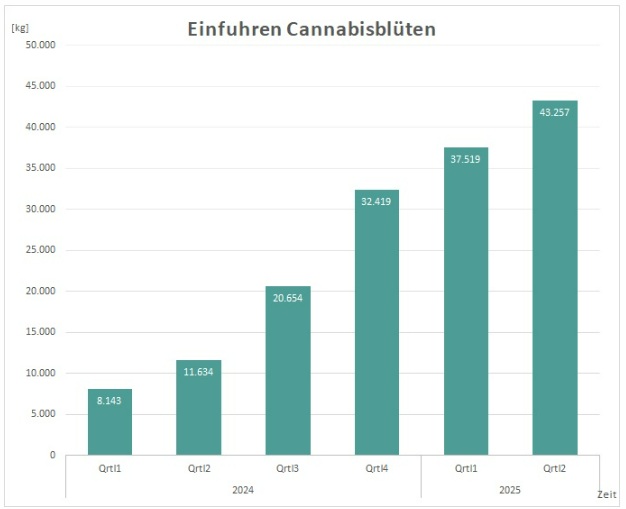

BERLIN – Germany’s medical Cannabis market continues to set records, with imports reaching 43.3 tons in the second quarter of 2025, according to data from the Federal Institute for Drugs and Medical Devices (BfArM). This marks a 5.8% increase over the previous high of 37.5 tons in Q1 2025, bringing the first half of the year to a total of 80.8 tons [four times higher than the same period in 2024], when imports stood at roughly 20 tons. The surge, driven by regulatory changes and growing patient demand, has ignited a debate over whether the imported Cannabis is primarily serving medical needs or being diverted to recreational use.

The data, reported by industry outlet KrautInvest, reflects a sharp rise in imports since the Cannabis Act (CanG) and Medical Cannabis Act (MedCanG) took effect in April 2024, removing Cannabis from Germany’s narcotics list. This reclassification has streamlined prescribing and dispensing processes, leading to a 15% increase in imports from Q1 to Q2 2025. Canada remains the dominant supplier, contributing 20 tons in Q2, followed by Portugal with 13.5 tons.

However, the Federal Ministry of Health has raised concerns about the disparity between import volumes and statutory health insurance prescriptions, which have grown only modestly. The ministry suggests that recreational misuse may be driving the import boom, a view echoed by the German Medical Association and the Paritätischer Welfare Association. Markus Beier, chairman of the German Association of General Practitioners, noted that online providers aggressively advertising private prescriptions could be fueling non-medical use, particularly as only a narrow group of patients (such as those with multiple sclerosis or in palliative care) typically qualify for medical Cannabis.

Industry stakeholders have pushed back against these claims. Cantourage, a leading Cannabis supplier, argues that Germany’s patient share remains lower than in other countries with mature medical Cannabis markets, suggesting untapped legitimate demand. The German Hemp Association (DHV) points to physicians’ reluctance to prescribe Cannabis, which may limit access for eligible patients. Meanwhile, the Business of Cannabis (BPC) calls for a more nuanced analysis, cautioning against broad assumptions of misuse without clearer data on patient uptake.

One critical gap in understanding the market lies in the lack of precise figures on how much imported Cannabis reaches patients through pharmacies. Before reclassification, approximately 60% of imports were dispensed to patients, with the remainder used for research or destroyed due to quality issues. Since April 2024, BfArM no longer tracks pharmacy-level data, leaving uncertainty about current distribution patterns. Niklas Kouparanis, CEO of Bloomwell Group, estimates that a higher proportion of imports now reaches patients, driven by telemedicine platforms and e-prescriptions. Bloomwell’s data shows a 15-fold increase in new patients from March to October 2024, underscoring the role of digital access in expanding the market.

The rapid growth has not come without challenges. A draft amendment proposed by the Federal Ministry of Health in June 2025 seeks to tighten regulations on telemedicine prescriptions, including mandatory in-person consultations and a ban on direct-to-patient deliveries. The German Cannabis Business Association (BvCW) warns that such measures could restrict access, particularly for rural patients who rely on online services due to limited access to specialized pharmacies. Bloomwell’s data indicates that nearly half of medical Cannabis patients live more than 10 kilometers from a licensed pharmacy, raising concerns that restrictive policies could push some back to the black market.

As Germany charts a course through this unprecedented growth, the tension between expanding access and preventing misuse remains a focal point. The market’s potential to exceed 100 tons in imports for 2025 depends on the balanced approach of regulators in addressing patient needs while maintaining oversight. Domestic production, now expanding with companies like DEMECAN and Tilray’s Aphria RX, may alleviate reliance on imports, but the immediate future hinges on policy decisions. The Federal Ministry of Health’s forthcoming report on the CanG Act’s impact, expected later this year, will likely shape the next phase of Germany’s medical Cannabis framework.