Cultivation Sector Outshines Modest Cannabis Capital Drop, Viridian Capital Advisors Reports

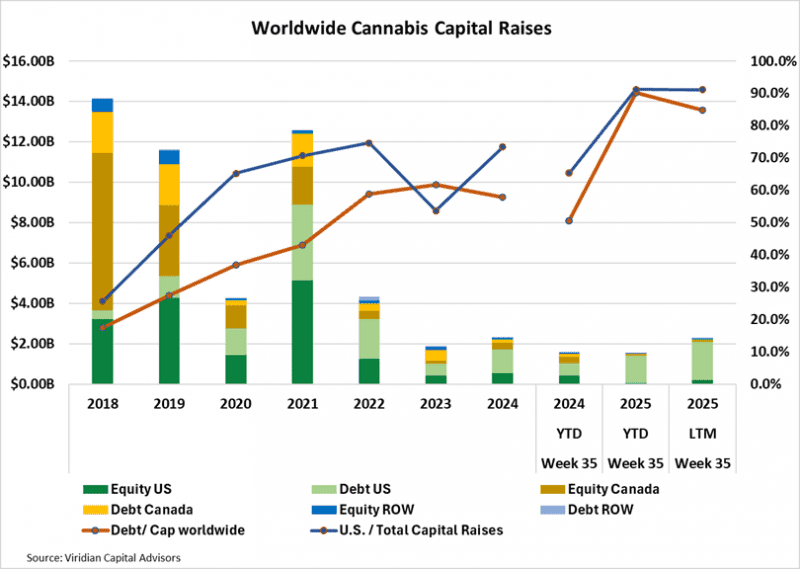

LOS ANGELES – Capital raising in the Cannabis industry has dipped slightly this year, with year-to-date (YTD) totals reaching $1.54 billion as of September 2025, a 2.4% drop from $1.58 billion in the same period last year. On a last-12-months basis, the figure stands at $2.3 billion, down 1.6% from 2024.

A notable shift has occurred in funding sources: debt now makes up 90.2% of worldwide raises, nearly double the 50.5% seen previously. This trend points to companies favoring borrowing over equity sales, possibly to avoid share dilution in a market where valuations remain under pressure from regulatory hurdles and competition.

Geographically, U.S.-based raises dominate, accounting for 91.3% of the total, up sharply from 65.3% in 2024. Funds from regions outside the U.S. and Canada fell to 3.7%, below the six-year average of 5.33%, signaling a concentration of activity in North America. Public companies captured 91.2% of last-12-months raises, the highest share in at least seven years, which suggests investors are gravitating toward established players with greater transparency and liquidity.

In the cultivation and retail segment, however, fundraising has accelerated. YTD totals hit $1.12 billion, an 82.8% increase from $614.1 million last year. Over the last 12 months, this sector raised $1.67 billion, up 43.9% from 2024 (and that year itself saw a 167% jump from 2023). Debt dominates here too, comprising 94.9% of funds, with large issues over $100 million representing 51.9% of the total, compared to none in 2023.

From a financial perspective, this heavy debt reliance could bolster short-term expansion for growers and retailers amid rising demand, but it also heightens leverage risks if interest rates stay elevated or sales growth slows.

These figures, drawn from data compiled by Viridian Capital Advisors, highlight a bifurcated market: broader industry funding is stable but tilting toward debt, while key operational sectors like cultivation show robust growth – the sign of resilience in core areas, yet it underscores the need for diversified funding strategies to weather potential economic headwinds and sustain long-term viability.

Source: Viridian Capital Advisors