Cronos Targets Europe Through Dutch Cannabis Leader Acquisition

TORONTO – Cronos Group Inc. has agreed to buy CanAdelaar B.V., the top supplier in the Netherlands’ controlled adult-use Cannabis program, for $67 million upfront plus performance incentives. The move marks Cronos’s first major step into Europe’s most developed recreational Cannabis sector.

The Toronto-based company’s subsidiary signed a binding share purchase contract on December 9, 2025, to take full ownership of CanAdelaar, which runs the only large-scale greenhouse operation among the program’s 10 licensed growers. The initial payment of €57.5 million covers all shares, with extra cash tied to half of CanAdelaar’s adjusted EBITDA in 2026 and 2027. That base price equates to 1.4x CanAdelaar’s past-year sales and 2.4x its earnings measure, a multiple that analysts view as reasonable given the target’s dominant position.

CanAdelaar, founded in 2018 and licensed in mid-2023, cultivates and packages products at a 540,000-square-foot site in Voorne aan Zee, supplying 72 coffee shops across 10 Dutch cities under the Wietexperiment (Closed Cannabis Chain Experiment). This government trial, launched in 2020 to test a licensed supply chain and curb black-market risks, shifted to full operations in April 2025 after a preparatory period. Rules bar imports, exports, and cross-supplier trades, creating a sealed system that favors established players like CanAdelaar, which holds the largest slice of the market.

For Cronos, the acquisition secures immediate leadership in the Dutch legal Cannabis pilot through CanAdelaar, one of the licensed producers, which reported revenue of US$17.7 million in 2024 and US$47.3 million in the twelve months ended September 30, 2025, with projections for steady growth as the program matures. It also aligns with the company’s push into “borderless” goods [think genetics and formulations that could adapt across regions] drawing on Cronos’s research investments. Mike Gorenstein, the company’s chairman, president and CEO, called the purchase “financially compelling and highly strategic,” noting the Netherlands’ role in shaping global Cannabis standards through its historic coffeeshop model.

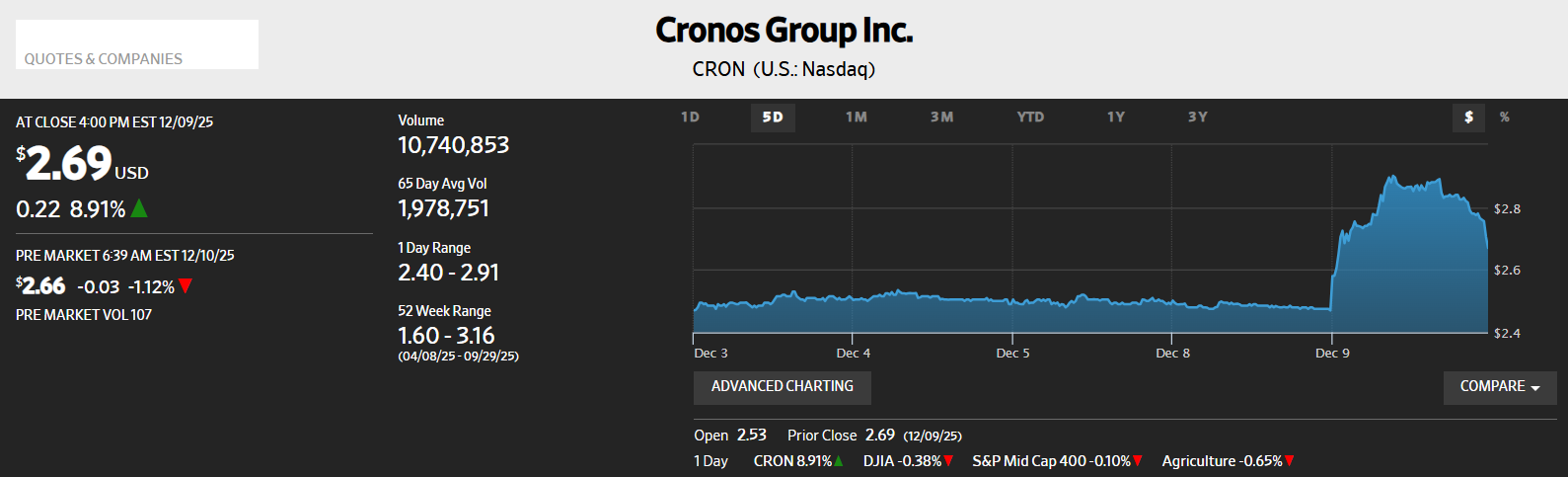

On the numbers side, the deal looks accretive. Cronos, with $824 million in cash reserves, short-term investments, and $1.74 million debt, can fund it outright, and forecasters see it boosting the parent’s revenue by 15-25% by 2027. Shares in Cronos climbed 12%, reflecting investor relief after years of flat performance in its core Canadian and Israeli operations. Yet, success depends on the trial’s extension beyond 2027; without it, the closed-loop setup could limit scale, and regulatory hurdles in the Netherlands remain a wildcard for closing, targeted for early next year.

Wrapping up, this transaction underscores a broader pattern in Cannabis: producers chasing regulated recreational channels where margins hold up against illicit competition. What’s at stake for Cronos is whether a targeted buy in a niche program can translate into wider continental gains, especially as Germany and other European countries weigh similar reforms. In an industry still grappling with uneven legalization, such calculated entries offer a blueprint for sustainable expansion, one that prioritizes proven operations over speculative bets.