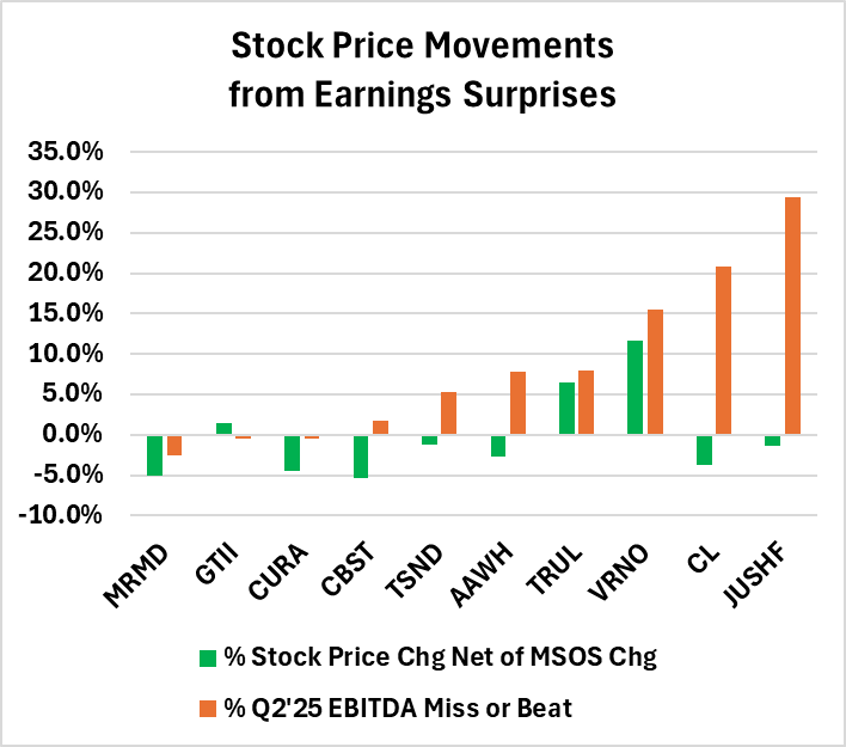

Cannabis Stocks Show Sensitivity to Q2 2025 Earnings Despite Market Volatility

LOS ANGELES – In the Cannabis industry, where trading often revolves around speculation and regulatory rumors, a recent analysis suggests that core financial performance still influences investor behavior. According to a recent report from Viridian Capital Advisors, industry stocks respond to quarterly earnings surprises, challenging the notion that fundamentals take a backseat.

Viridian’s latest Chart of the Week examines Q2 2025 financial results for several key players. By comparing stock price movements around earnings releases (adjusted against the broader MSOS ETF to filter out market-wide swings) Viridian highlights a correlation with EBITDA outcomes relative to analyst expectations. Positive surprises, represented in the data, generally led to net gains in share prices, while misses prompted declines, though not without exceptions.

For instance, companies like Jushi Holdings and Cresco Labs exceeded EBITDA forecasts but saw minor stock dips, possibly due to other factors like debt refinancing announcements or their absence. Conversely, firms reporting on days of sharp ETF rallies faced tougher benchmarks in the normalized analysis. Overall, the pattern indicates that earnings beats can bolster prices, even amid thin liquidity and rumor-driven trades.

From a financial standpoint, this data underscores the enduring role of operational metrics in a sector prone to external noise. In Cannabis, where illiquidity amplifies short-term distortions, consistent EBITDA performance signals underlying business health, potentially attracting more institutional interest over time. Yet anomalies in the results remind investors that no single factor dominates; broader catalysts, like debt management, can temper reactions.

Tese insights affirm that diligent fundamental analysis remains a valuable tool for navigating Cannabis equities. For stakeholders, it means balancing hype with hard numbers to gauge true value amid ongoing uncertainties.

Source: Viridian Capital Advisors