Cannabis Stocks Climb 79% in a Month, But Path to Past Highs Remains Uncertain

LOS ANGELES – Publicly traded Cannabis companies have seen sharp gains recently, with the AdvisorShares Pure US Cannabis ETF (MSOS) climbing about 79% over the past month. This rally prompts questions about sustainability and potential for further upside, according to analysis from Viridian Capital Advisors.

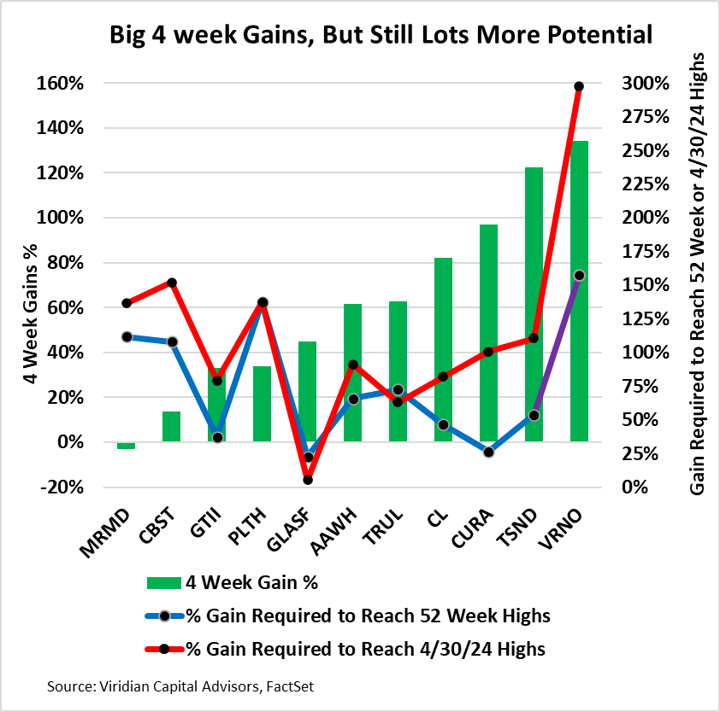

The firm’s latest chart highlights monthly price increases for 11 key players, ranging from a 14% rise for Cannabist to a 134% jump for Verano Holdings. Only Marimed posted a decline. Larger companies generally outpaced smaller ones, with market capitalization playing a role, incremental capital flowed toward bigger names like Curaleaf and Trulieve, which boast greater liquidity. Stocks listed on the Toronto Stock Exchange, such as Curaleaf and TerrAscend, benefited from broader access to institutional investors, ETFs, and retail accounts in Canada. Oversold conditions also fueled rebounds, as seen with Verano, which still needs a 157% gain to reach its 52-week high despite the recent surge.

Viridian notes that some stocks, including Green Thumb Industries, Glass House Brands, and Curaleaf, now sit within 40% of their 52-week peaks, which could signal near-term consolidation. More telling, however, are comparisons to April 30, 2024, when the U.S. Drug Enforcement Administration proposed shifting Cannabis to Schedule III. That announcement drove a market spike, pushing enterprise value to next-12-month EBITDA multiples for major operators to 10.91 times, versus 6.48 times today. Returning to those levels would require substantial further gains, as indicated in the analysis.

A prior peak on April 1, 2022, amid the introduction of the Marijuana Opportunity Reinvestment and Expungement (MORE) Act, saw multiples exceed 11 times. Viridian suggests that actual Schedule III enactment (unlike a mere proposal) could lift valuations higher, perhaps to 13 times, given direct cash flow benefits. Yet the firm tempers expectations, citing shifts since 2022: projected EBITDA margins for top firms have dropped from 32.9% to 27.5%, growth forecasts have cooled with new markets like New Jersey and New York now online, and wholesale price pressures have become a staple in industry reports.

From a financial perspective, this data underscores a market ripe for selective opportunities but fraught with risks. The current multiples reflect compressed fundamentals, making a full reversion to 2021 peaks above 20 times unlikely without major policy wins or margin recoveries. Investors might weigh entry points in liquid, large-cap names for any Schedule III momentum, but diversification remains key amid regulatory delays and competitive pricing. Valuations could expand meaningfully on concrete reforms, yet overreliance on historical benchmarks ignores today’s tighter economics.

The takeaway here is clear. While this rally signals renewed confidence, the true upside lies in policy execution and operational resilience, reminding stakeholders that patience, not speculation, will define the long-term winners in our sector.

Source: Viridian Capital Advisors