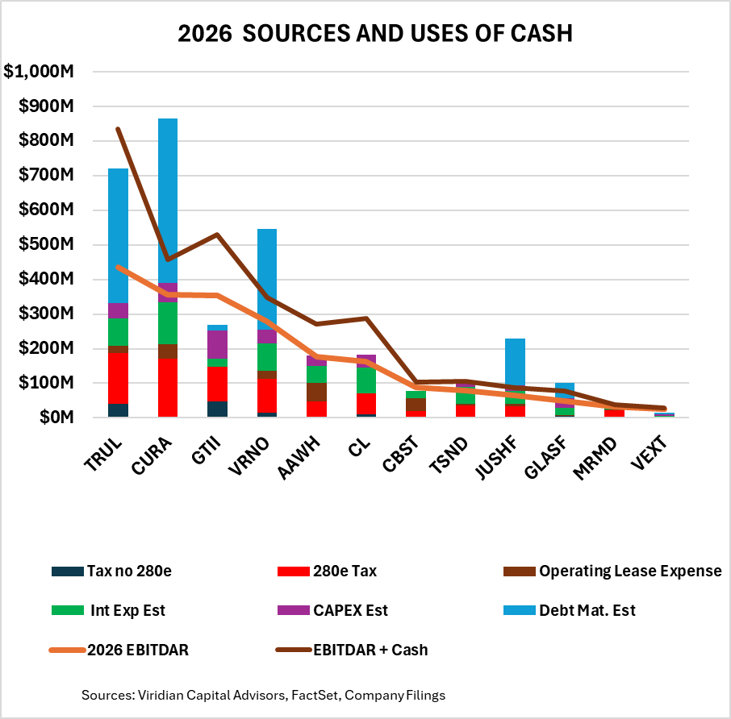

Cannabis MSOs Face Manageable 2026 Debt Maturities, Viridian Analysis Shows

LOS ANGELES – Major Cannabis operators are navigating a once-daunting wave of debt due in 2026 with greater ease than anticipated, according to a recent chart from Viridian Capital Advisors. The analysis examines cash sources and uses for 12 leading MSOs, highlighting fixed charges like taxes, leases, interest, capital expenditures, and maturing debt. It portrays these obligations as stacked bars, set against lines representing earnings before interest, taxes, depreciation, amortization, and rent (EBITDAR), as well as EBITDAR plus mid-2025 cash balances.

From a financial perspective, the data underscores resilience among top-tier firms. Companies like Trulieve, Curaleaf, Verano, and Cresco, which together faced about $1.5 billion in maturities earlier this year, demonstrate solid asset coverage and credit profiles.

Cresco has already refinanced $360 million, reducing the overall burden, while the others appear positioned to follow suit without major distress. However, the inclusion of Section 280E taxes (assumed here as cash outflows) adds conservatism; in practice, firms might defer payments if the provision persists, easing short-term pressure.

Weaker players like Cannabist, AYR, 4Front, and Jushi show higher leverage when factoring in comprehensive debt definitions, including leases and taxes. Jushi, for instance, maintains over 1x asset coverage but carries maturities large relative to its market cap, signaling ongoing vulnerability.

Viridian notes that early 2025 concerns have eased, with refinancings and extensions mitigating risks. Cannabist pushed obligations to 2029, while 4Front and AYR face lender interventions. The key uncertainty remains federal rescheduling: success could buoy market sentiment and facilitate deals, but failure might erode confidence and complicate terms.

This shift suggests the sector’s maturity wall, while not vanished, now tests strategic timing more than survival. MSOs must weigh waiting for potential regulatory tailwinds against proactive refinancing to secure favorable rates, a decision that could define their financial health in the years ahead.

Source: Viridian Capital Advisors