Cannabis Market’s Hidden Scale: New Estimates Point to $90B U.S. Potential

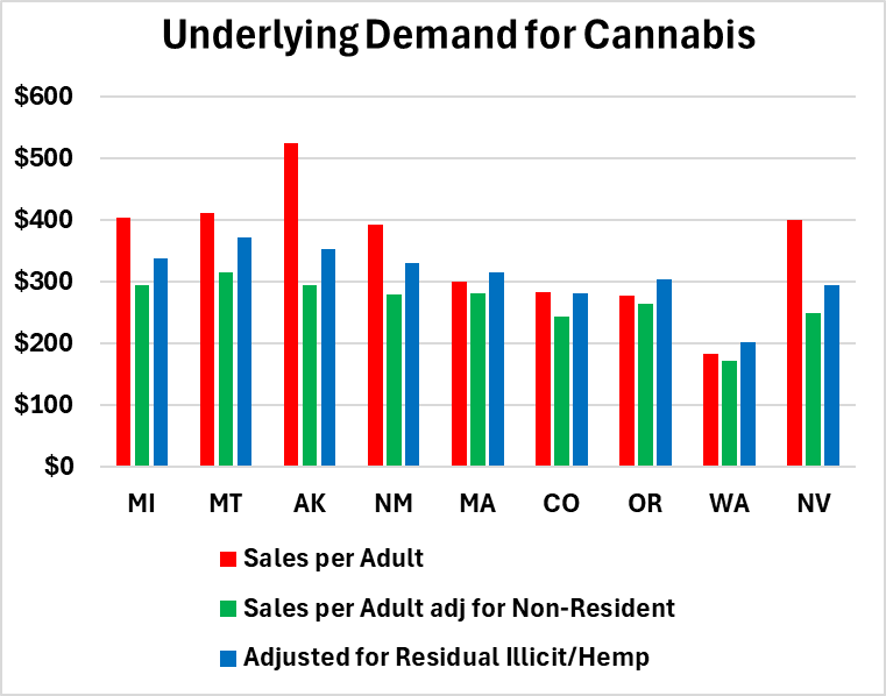

LOS ANGELES – Viridian Capital Advisors’ latest Chart of the Week dives into recreational Cannabis sales across nine mature markets (Michigan, Montana, Alaska, New Mexico, Massachusetts, Colorado, Oregon, Washington, and Nevada) to gauge true consumer appetite.

Using 2025 sales projections, Viridian Capital Advisors uncovers what looks like a consistent appetite among American adults: roughly $300 to $350 spent yearly on legal rec Cannabis, once you strip away tourists, out-of-staters, and black-market holdouts.

The firm’s data shows raw per-capita sales swinging wildly. But adjust for the roughly one-third of volume from non-residents in border hotspots like Michigan and New Mexico, or the 35% to 40% tourism lift in Alaska and Nevada, and the picture sharpens. Factor in another layer for persistent illegal buys and hemp alternatives, and those numbers settle into a narrow range across the board. Apply the above-mentioned $300-$350 spent by the adult population on legal Cannabis nationwide, and the full addressable pie swells to $81-$94 billion [!], overshadowing MJBizDaily’s $35 billion 2025 call based on $130 per adult.

Financially, the implications cut deep for a sector long starved of predictable scale. Snaring 80% of that untapped volume over five years could lift compound annual growth to 15.5-18.5%, eclipsing the low-single digits that have dogged forecasts amid supply gluts and tax drags. Savvy operators stand to gain from footprint expansion in low-density zones, where dispensary density mirrors Colorado’s playbook: aggressive rollout to choke illicit flows and lock in loyalty. Margins may thin initially under pricing wars, but throughput surges could juice returns, favoring consolidators with lean ops over fragmented upstarts. Federal headwinds [reclassification delays, hemp crackdowns] pose the wild cards, yet the data sketches a trajectory toward defensible economics in a maturing field.

Viridian Capital Advisors’ crisp breakdown arms investors with a yardstick for the long game. In a patchwork of state regimes, the true measure of progress lies not in outlier spikes but in bridging to this $300-$350 norm, a threshold that could finally tilt Cannabis from niche gamble to staple revenue stream, as long as execution keeps pace with the math.

Source: Viridian Capital Advisors