Cannabis Market Faces Inevitable Wave of Consolidations to Keep the Pace of Dynamics

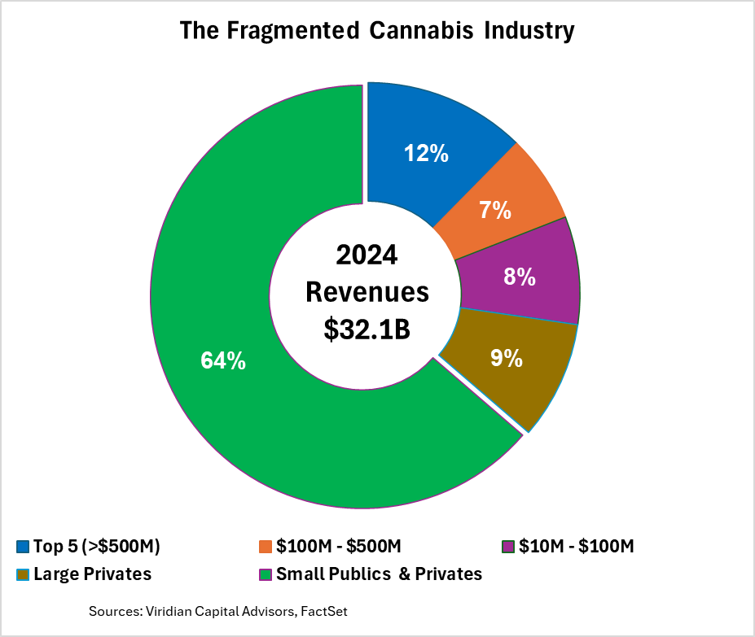

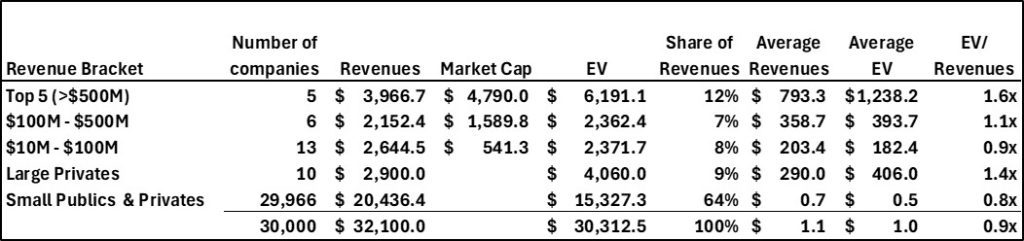

LOS ANGELES – Viridian Capital Advisors’ Chart of the Week painted a picture of a highly fragmented U.S. Cannabis industry, where the top five multi-state operators (MSOs) generated about $4.8 billion in revenue, equating to roughly 12% of the total market, a notable drop from 17% in 2021.

This erosion stemmed from gains by large private entities and smaller public firms, which collectively boosted their share by 8% over the period. Meanwhile, an estimated 30,000 small operators, each averaging $0.7 million in annual revenue, dominated with around 64% of 2021 sales, underscoring the sector’s grassroots structure. In stark contrast, the beer industry exhibited far greater concentration, with its top five players commanding 79% of revenues in 2024 (up from 73% in 2021), while 9,800 craft breweries held just 21%.

Fast-forward to 2025, and these trends have persisted with incremental shifts. The U.S. Cannabis market has expanded to approximately $45 billion in annual revenue, reflecting steady growth amid state-level expansions and rescheduling discussions. However, fragmentation remains a hallmark: the top five MSOs, led by companies like Curaleaf, Green Thumb Industries, Trulieve Cannabis, Verano Holdings, and Cresco Labs, now capture an estimated $4.5 billion, still hovering around 10% market share, with no single entity exceeding 3%. Smaller firms continue to hold the lion’s share, though updated figures suggest their collective dominance has slightly moderated as private capital flows favor scalable operations.

In the beer sector, consolidation has deepened further. By mid-2025, the number of craft breweries dipped to 9,269 (a 1% YoY decline), with production volumes falling 4% in the H1 2025, mirroring a broader 3.9% drop in craft output for 2024. Craft’s overall market share stabilized at 13.3%, while the top five producers, dominated by Anheuser-Busch InBev, Molson Coors, Constellation Brands, Heineken, and Pabst, maintained around 79% of revenues, benefiting from efficient supply chains and brand loyalty. This disparity highlights Cannabis’s relative immaturity, where regulatory silos across states hinder national scaling.

Viridian posed a central question: Is consolidation an opportunity, threat, or inevitability? Their view leaned toward inevitability, arguing it would elevate return on invested capital (ROIC), which lags behind comparable sectors like alcoholic beverages due to limited pricing power and high capital intensity. Consolidation, they noted, could foster oligopolistic structures for better margins, while interstate commerce [potentially unlocked by federal reforms] would enable economies of scale in cultivation and distribution.

This perspective holds in 2025, with added nuance from ongoing trends. Cannabis ROIC remains subdued, often trailing alcohol’s by 5-10% points, hampered by factors like Section 280E taxation (which disallows standard deductions) and volatile wholesale prices averaging $1,098 per pound in August. Yet, signs of improvement emerge: MSOs’ enterprise value-to-next-twelve-month (EV/NTM) revenue multiples rose 84% from April lows of 1.05x to peaks of 1.93x, signaling investor optimism around rescheduling and debt refinancings that ease 2026 maturities. Larger MSOs enjoy a cost-of-capital advantage, with EV/EBITDA multiples around 8.24x for 2024 consensus, compared to smaller peers’ lower valuations, making growth financing tougher for the latter.

Viridian’s optimism for smaller players, drawing parallels to thriving craft breweries and vineyards in premium niches, resonates amid 2025’s realities. While observers fear consolidation threatens viability, beer and wine demonstrate coexistence: thousands of small entities succeed by targeting high-margin, artisanal segments despite volume dominance by giants. In Cannabis, this could translate to craft producers focusing on organic, strain-specific products or local retail experiences, even as M&A activity rebounds after a dip, with experts forecasting a wave driven by adjacent-sector entrants.

Viridian predicts a doubling of large competitors’ revenue share over five years, a forecast that appears on track given 2025’s M&A uptick and state reforms in markets like Florida and Pennsylvania. Capital intensity demands [building national brands, distribution networks, and centralized facilities] favor well-funded players, while smaller ones adapt through partnerships or niche strategies.

In a sector tuned for consolidation, the true game-changer lies not in sheer scale or niche survival alone, but in forging hybrid ecosystems where large MSOs and small craft producers collaborate as symbiotic partners, much like how tech giants integrate startups in software. As alcohol and tobacco behemoths play their games, savvy MSOs, like the recent move of Agrify (read Green Thumb), could acquire distribution while outsourcing innovation to agile small firms, creating resilient value chains that boost industry-wide ROIC to alcohol-like levels (15-20%) by 2030. This model mitigates threats to independents, accelerates federal adaptation, and positions Cannabis as a diversified consumer staple, ultimately yielding higher returns for investors who bet on interconnected growth over zero-sum dominance.

Sources: Viridian Capital Advisors, Brewers Association