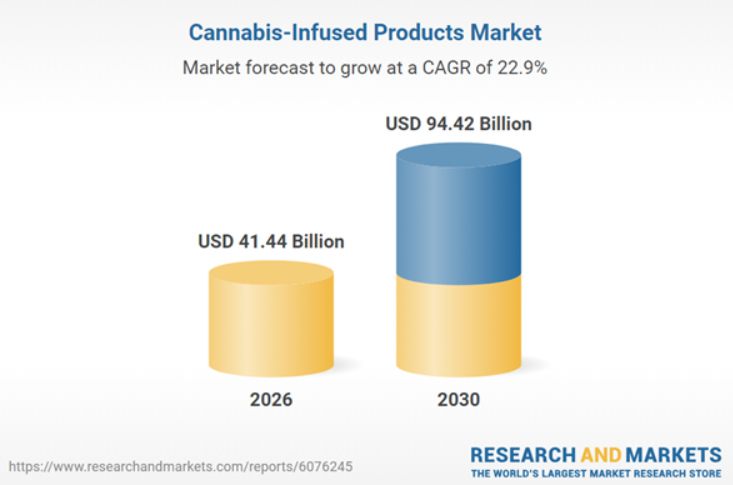

Cannabis-Infused Products Market to Reach $41B Billion in 2026, Research and Markets Reports

LOS ANGELES – Research and Markets has published its latest report on the Cannabis-infused products sector, forecasting the global market to grow from $33.62 billion in 2025 to $41.44 billion this year, a compound annual growth rate of 23.2%. The analysis extends the outlook through 2030, when the market is expected to reach $94.42 billion at a 22.9% CAGR from 2026 onward.

The report attributes the expansion to continued legalization efforts in various regions, rising consumer acceptance, wider availability of medical Cannabis programs, and the proliferation of specialty retail channels. Additional drivers include:

- growing interest in wellness-oriented products,

- investments in branded offerings,

- the development of regulated recreational markets,

- demand for pharmaceutical-grade formulations, and

- the expansion of online sales platforms.

Product categories covered range from edibles and beverages to skincare, cosmetics, haircare items, and intimate products, with sources divided between hemp- and Cannabis-derived ingredients. Distribution channels include both business-to-business and direct-to-consumer models, while end-use segments span medical, personal care, pharmaceutical, and general wellness applications.

North America remains the dominant regional market, though growth potential appears in other areas such as Asia-Pacific.

The document profiles major participants including Curaleaf Holdings, Trulieve Cannabis, Green Thumb Industries, Cresco Labs, Tilray, and Canopy Growth. It also notes recent developments like advancements in emulsion technology for beverages and strategic acquisitions aimed at expanding portfolios.

Broader trends include the continued popularity of edibles and drinks, greater incorporation of CBD into wellness items, emphasis on consistent labeling and quality standards, adoption of improved extraction processes, and the introduction of new consumption formats. These patterns point to consumer demand for discreet, accurately dosed, and varied options.

The findings reflect a sector that continues to mature through regulatory progress, product innovation, and shifting consumer preferences, though operators still face compliance requirements and competitive pressures. As more jurisdictions formalize frameworks and technology enhances quality and consistency, Cannabis-infused products are positioned to account for a growing portion of total Cannabis spending in medical, recreational, and wellness contexts.

Cannabis-infused products are no longer a niche add-on but a primary engine of revenue diversification and long-term profitability. Operators who prioritize innovation in formulation, dosing accuracy, quality standardization, and multi-channel distribution [while navigating persistent compliance hurdles] stand to benefit most as the market matures. The data points to a future where Cannabis consumption increasingly resembles mainstream CPG categories, with edibles and wellness formats driving the next phase of expansion well into the 2030s.