Cannabis Earnings Outlook Dims as Q2 2025 Looms, Latest Analysis

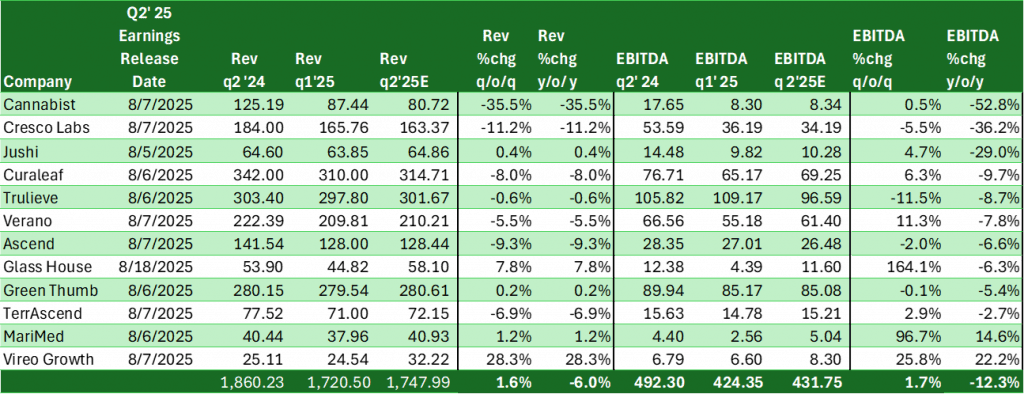

LOS ANGELES – As the Cannabis industry braces for Q2 2025 earnings releases in early August, a sobering picture emerges from Viridian Capital Advisors’ Chart of the Week. Ten of twelve tracked companies are projected to see year-over-year EBITDA declines, with an aggregate drop of 12.3%. Only Vireo Health and MariMed buck the trend, with Vireo’s gains tied to recent acquisitions boosting revenue and MariMed’s driven by improved margins.

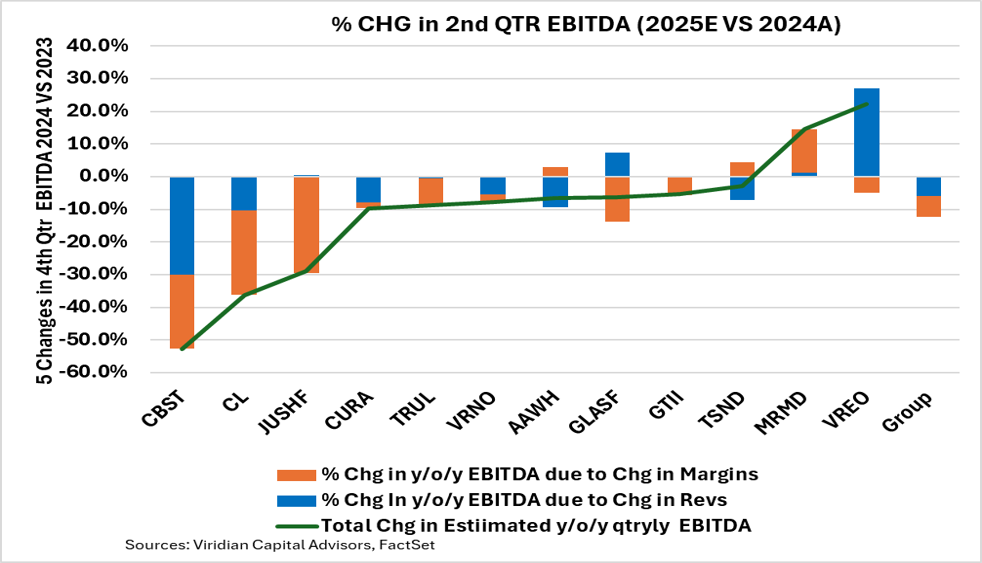

The downturn is largely fueled by shrinking EBITDA margins, as shown below in Viridian’s chart decomposing the EBITDA changes into revenue (blue bars) and margin (orange bars) components. Only Ascend Wellness and TerrAscend are expected to post higher margins compared to Q2 2024. Persistent inflation in input costs, coupled with price compression and a shift toward lower-cost, lower-margin products, is squeezing profitability across the sector.

Looking ahead, analysts project a rebound in 2026, with 6% revenue growth and nearly 10% EBITDA gains, pinned on new adult-use markets like Pennsylvania and Virginia. However, Viridian cautions that these forecasts may be overly optimistic, potentially requiring downward revisions. The data underscores the need for vigilant credit modeling, with investors advised to prioritize credits ranked in the top 15 of Viridian’s Credit Tracker model.

Despite the challenges, the Cannabis industry’s resilience shines through. Companies like Vireo and MariMed demonstrate that strategic moves (whether through acquisitions or operational efficiency) can defy headwinds. As the sector navigates this turbulent period, the path to growth hinges on adapting to an evolving market, where only the most agile will thrive.