Cannabis Debt Yields Show Wide Gaps Among Top Operators, Viridian Analysis Finds

LOS ANGELES – A fresh assessment of credit profiles among leading U.S. Cannabis companies points to notable discrepancies in debt pricing that could signal untapped value for savvy investors and fixed-income players.

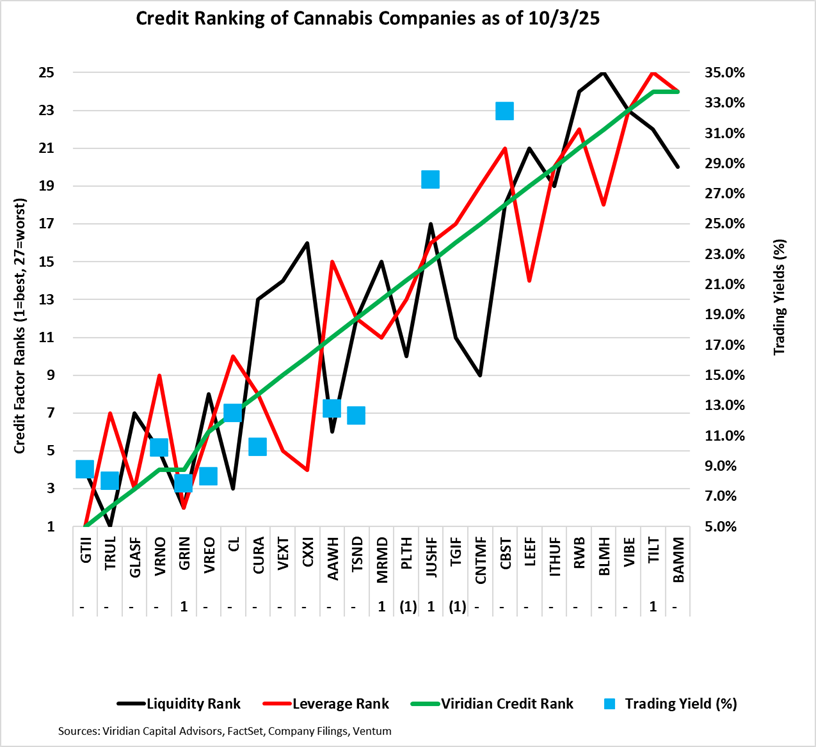

Viridian Capital Advisors released its Weekly Credit Report, ranking the top 25 cultivation and retail operators based on 11 key market and financial ratios. These metrics feed into evaluations of liquidity, leverage, profitability, and company scale, which combine to form an overall credit score and position.

The analysis uncovers several pricing anomalies. Cresco Labs’ recent five-year loan, for instance, commands more than 400 basis points above Vireo Health’s comparable placement, even though Viridian rates Vireo just one slot higher on credit quality. From a financial perspective, this spread appears outsized given the modest rating gap; it may reflect short-term market jitters over Cresco’s operational costs, but the underlying balance sheet metrics [stronger cash reserves and lower leverage ratios] suggest room for yields to compress as lender familiarity grows.

Verano Holdings’ debt due in 2026 trades at a 200-basis-point premium to Trulieve Cannabis’ notes maturing the same year. Viridian acknowledges Trulieve’s superior credit standing, driven by higher profitability margins and broader market share. Yet the yield differential strikes as steep, particularly after Verano secured a $75 million revolving credit facility from Chicago Atlantic last week. That deal, priced favorably, could pave the way for refinancing the balance of Verano’s 2026 obligations, potentially narrowing the gap and rewarding holders who buy in now at elevated rates.

Cresco’s paper also lags behind Ascend Wellness Holdings’ for matching terms, despite Viridian’s model deeming Cresco the stronger credit on liquidity and size fronts. Here, the market’s indifference might stem from Ascend’s recent expansion funding, but Cresco’s steadier earnings trajectory points to undervaluation, offering a potential 150-basis-point edge for investors willing to hold through maturity.

Overall, the Cannabis debt arena delivers yields hundreds of basis points richer than benchmark high-yield issues with parallel risk profiles, a draw in a market where corporate borrowing costs hover around 7% for speculative-grade names. These spreads underscore the sector’s fragmentation, where operational variances amplify pricing inefficiencies.

These patterns serve as a reminder that disciplined credit analysis can unearth real edges in an asset class still maturing. Investors eyeing entry should weigh the yields against execution risks, but the data makes a clear case: overlooked debt here carries the potential to outperform broader fixed-income plays, provided the operators deliver on their fundamentals.

Source: Viridian Capital Advisors