Weedmaps’ WM Technology Faces SEC Scrutiny Over Misleading Investor Reports

NEW YORK–WM Technology, Inc. (Nasdaq: MAPS), best known for its cannabis-focused platform, Weedmaps, has found itself at the center of an SEC investigation over misleading user metrics. The California-based company recently agreed to pay a $1.5 million fine to settle the matter, which stems from several violations of federal securities laws. At the core of the issue was WM Technology’s use of inflated user statistics to bolster investor confidence, a move that has had significant ramifications for the company and its leadership.

The Rise of Weedmaps and WM Technology

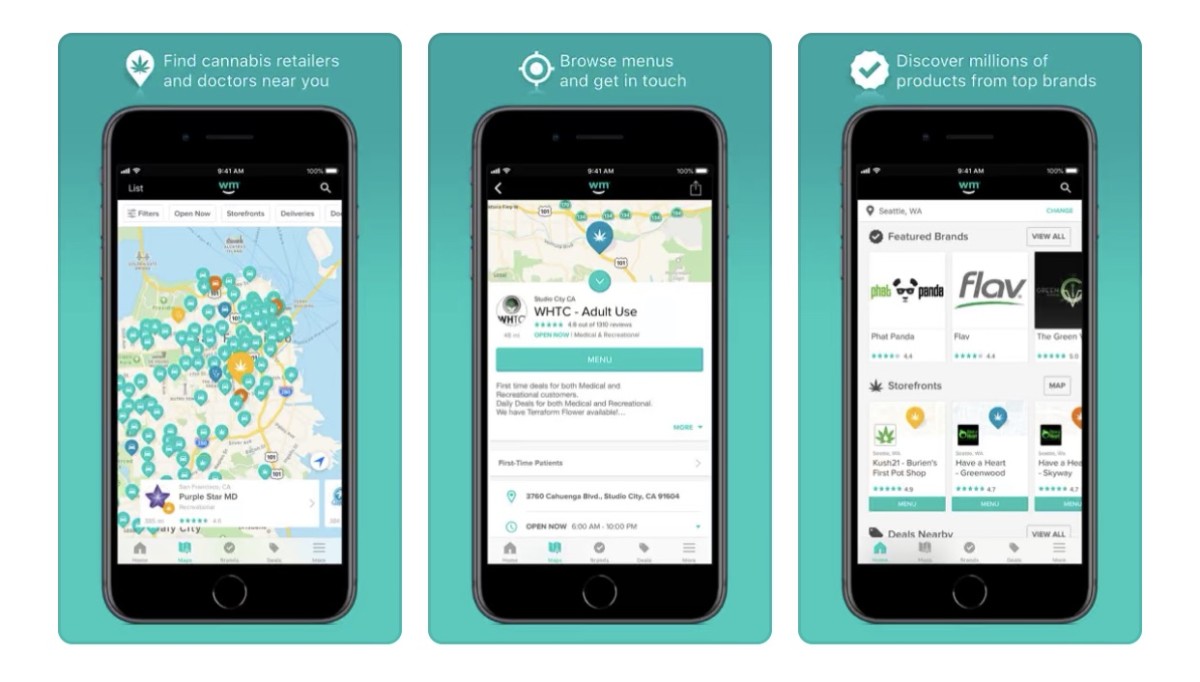

Weedmaps was founded in 2008, quickly rising to prominence as a key player in the cannabis industry. The platform serves as a directory for dispensaries and cannabis products, connecting consumers with local businesses. As the cannabis industry evolved, Weedmaps expanded its services, offering advertising, software, and data solutions to cannabis companies. Weedmaps became a go-to resource for both consumers and cannabis businesses, eventually positioning itself as a leader in the burgeoning industry.

In 2021, WM Technology took Weedmaps public through a special purpose acquisition company (SPAC), going public on the Nasdaq under the ticker symbol MAPS. At the time, the move was seen as a significant milestone for the cannabis industry, as Weedmaps represented one of the most well-established and recognizable brands in the space. But as the company attempted to navigate the pressures of being publicly traded, cracks began to show in its business practices.

The SEC Investigation

The U.S. Securities and Exchange Commission’s (SEC) investigation revealed that WM Technology misled investors by artificially inflating its monthly active user (MAU) metrics between 2021 and 2022. According to the SEC’s findings, the company included users who had not actively engaged with the Weedmaps website, such as individuals who were redirected from pop-up ads on third-party websites. These visitors were counted as “active users” despite not interacting with the platform in a meaningful way. The inflated MAU numbers created the appearance of rapid growth and engagement, bolstering WM Technology’s performance in quarterly reports and earnings calls.

READ THE DETAILED SEC ACTION: CLICK HERE

Former CEO Chris Beals and former CFO Arden Lee, who were both named in the SEC’s investigation, highlighted the company’s purported MAU growth to investors during earnings calls from August 2021 to May 2022. The company’s filings reported that monthly active users increased from 9.1 million in early 2021 to 16.4 million by mid-2022. However, internal records told a different story. According to the SEC, less than 2% of the users redirected from pop-up ads engaged with the Weedmaps site, and overall user engagement was either stagnant or declining during the period in question.

The investigation also uncovered that by 2022, up to 65% of Weedmaps’ reported monthly active users were from redirected traffic, raising further concerns about the legitimacy of the company’s reported growth. Despite this, Beals and Lee continued to sign off on regulatory filings that relied on the misleading MAU figures. In August 2022, the issue came to light when an internal complaint was filed with WM Technology’s board of directors, prompting a deeper look into the company’s reporting practices.

Consequences for WM Technology

The SEC charged WM Technology with making “untrue and misleading statements” about its user metrics and failing to disclose that a significant portion of its reported user base came from pop-up ads. The company eventually agreed to a $1.5 million settlement to resolve the charges, which included a cease-and-desist order from the SEC.

The consequences extended beyond the financial settlement. In November 2022, Chris Beals stepped down as CEO, and in December of the same year, WM Technology laid off 25% of its workforce as part of a broader restructuring effort. Arden Lee, the company’s CFO, resigned in July 2023, further signaling the upheaval within WM Technology’s leadership.

The company’s financial performance has also been impacted. After posting a net income of $152.2 million in 2021, WM Technology reported a loss of $82.7 million in 2022. The company continued to struggle in 2023, with a net loss of $15.7 million, reflecting broader challenges within the cannabis industry as well as internal instability.

A Cautionary Tale for the Cannabis Industry

The situation with WM Technology and Weedmaps serves as a cautionary tale for cannabis companies operating in an increasingly competitive and regulated environment. As more cannabis businesses go public, they face heightened scrutiny from regulators and investors alike. Transparency, accurate reporting, and adherence to best practices are critical for maintaining investor confidence and ensuring long-term sustainability.

The SEC’s investigation into WM Technology highlights the importance of clear and honest communication with investors. Inflated or misleading metrics not only damage a company’s reputation but also expose it to legal and financial risks. In the case of WM Technology, the use of non-engaged traffic to inflate user numbers may have initially created a positive narrative for investors, but the long-term consequences have proven far more damaging.

What’s Next for Weedmaps?

Despite the challenges, WM Technology continues to operate, and Weedmaps remains a key player in the cannabis industry. In response to the SEC investigation, the company has taken steps to revise its reporting practices. Notably, Weedmaps discontinued its reliance on monthly active user metrics and shifted to reporting on the number of paying clients each quarter, a more transparent and reliable indicator of the company’s performance.

While the company’s leadership changes and financial losses have raised concerns, Weedmaps still holds a prominent position in the cannabis ecosystem. The platform’s widespread recognition and established relationships with cannabis businesses provide a strong foundation for future growth. However, the road ahead will require careful navigation, particularly as the cannabis industry continues to evolve and face new regulatory challenges.

Lessons for Cannabis Companies and Investors

For other cannabis companies looking to go public or attract investment, the WM Technology case offers several key lessons. First, accurate and transparent reporting is essential. In an industry where regulatory oversight is increasing, any misrepresentation of key business metrics can lead to serious consequences, including fines, leadership changes, and loss of investor trust.

Second, companies must be prepared to adapt to the changing landscape of the cannabis industry. As more states legalize cannabis and federal legalization remains a topic of discussion, businesses must stay ahead of regulatory changes and consumer trends. Relying on outdated or misleading practices, such as inflating user metrics, is a recipe for disaster.

Finally, investors in the cannabis industry should exercise due diligence and critically assess the information provided by companies. While cannabis represents a significant growth opportunity, it also comes with unique risks. Understanding the regulatory environment and the operational realities of cannabis businesses is crucial for making informed investment decisions.

John Ryan, Highly Capitalized Network