Schwazze Posts $18.5 Million Loss in 2022 Due to Expansion into New Mexico and Acquisitions, But Sees Strong Revenue Growth and Retail Sales

LOS ANGELES– Schwazze Inc., formerly known as Medicine Man Technologies Inc. and based in Denver, Colorado, has reported a net loss of $18.5 million for the full year of 2022, a significant downturn from its $12.8 million profit in 2021. The loss was attributed to the company’s various acquisitions and expansion into New Mexico.

Despite the substantial loss, Schwazze reported impressive growth in other key areas. The company’s revenue for the full year increased by 47% to $159.4 million, compared to $108.4 million in 2021, while fourth-quarter revenue was up 51% to $40.1 million. The gross profit for the year increased by 72% to $85 million, compared to $49.4 million in 2021, with a fourth-quarter profit up 89% to $23 million. Retail sales skyrocketed to $141.3 million, representing a 92% increase from $73.8 million in 2021, and fourth-quarter sales saw an 87% increase to $36.9 million. Cash flow also increased by 35% to $11.4 million, compared to $8.4 million in 2021, with fourth-quarter cash flow up by 50% to $5.4 million.

However, the company’s seven-company acquisition spree in 2022 and expansion into New Mexico came at a cost, resulting in an 85% increase in operating expenses to $72.2 million, and a 26% increase in the cost of goods and services to $74.3 million. At the end of 2022, Schwazze had $38.9 million in the bank, compared to $106.4 million at the close of 2021.

Schwazze’s expansion and acquisition activities included ten dispensaries, four cultivation facilities, and a manufacturing facility in New Mexico, two dispensaries in Boulder, Colorado, two indoor cannabis grows and a dispensary in Denver, and two dispensaries in Glendale and Manitou Springs, Colorado. The company also signed deals to acquire two more Colorado storefronts, one each in Fort Collins and Garden City, bringing its retail footprint to 45 dispensaries.

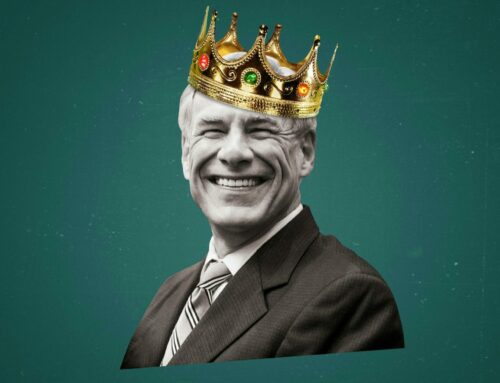

CEO Justin Dye expressed optimism for the company’s future, stating that Schwazze is “well-positioned to play offense in this challenging environment.” Dye believes that the company’s strategy and playbook will continue to deliver positive results in the future, despite the ongoing market challenges.