New Cannabis Brands Face Shorter Lifecycles, With Survival Rates Tied to Market Conditions

LOS ANGELES, A new report by sale tracking firm Headset has found that new cannabis brands entering the market have shorter lifecycles than in the past. The report analyzed distinct brand launches in the first month of every year since 2020 and whether those brands recorded a sale after the following December. Overall, around 17% of new U.S. cannabis products that launched in January 2022 managed to survive through the end of the year, reflecting a slowdown in overall consumer spending, especially in mature markets.

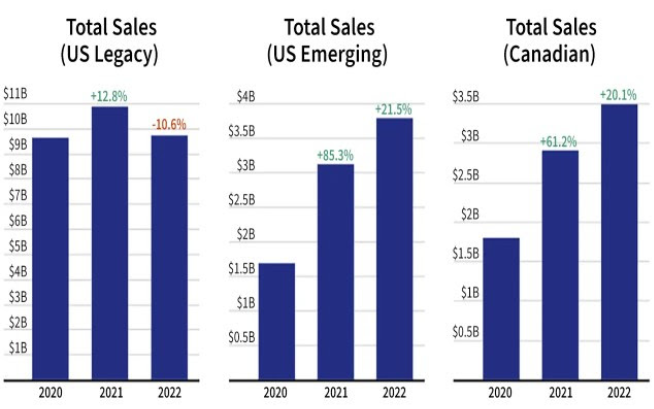

However, the report found that trends in the survival rates of new products vary across markets. In emerging markets, such as Canada and some parts of the U.S., new products have experienced rising sales, which closely relates to the growth rate in new products released over the last few years. Even in markets where there has been price compression across retail offerings, new product launches have increased. For example, in Missouri, the number of active brands skyrocketed nearly two-thirds in the first nine months of 2022, and revenue growth has continued despite average retail prices plummeting 40% since September 2021.

The report also found that the timing of new cannabis brand launches is not necessarily dictated by seasonality. In 2020, when U.S. legacy markets saw consumption spike due to the pandemic, sales hit their highest point in August, the same month that new product debuts also peaked. Nearly 57% of all new products hit the market between May and October. In contrast, U.S. emerging markets and Canadian markets have maintained steadier growth in sales and new product launches, where new products have been released mostly in the later halves of 2020 and 2021.

The report suggests that the market will continue to figure out how many products it can accommodate, as the downward trend in mature markets is likely to persist through 2023. Only pre-rolls are doing well in mature markets, with an increase in the launch of new products. This is consistent with the category’s growing popularity among consumers, which brands have seen as an opportunity for investment and product innovation. The report concludes that new product launches are very much a function of their own environment and context, which is important to understand when analyzing them.

(This information is primarily sourced from Reportlinker. Highly Capitalized has neither approved nor disapproved the contents of this news release. Read our Disclaimer here).