Multi-State-Operators (MSOs) Set to Enter NY Adult-Use Market After Policy Change

NEW YORK–In an effort to stabilize New York’s adult-use marijuana program, which has experienced a rocky rollout, new legislation and significant policy shifts have been proposed. One of the key changes is the potential entry of some of the nation’s largest multi-state operators (MSOs) into the expanded market by the end of this year.

The Office of Cannabis Management (OCM) has recently put forth revised regulations aimed at jump-starting the estimated $3 billion market by allowing for more retail locations. This move is expected to invigorate a supply chain that currently presents limited business opportunities.

Since the launch of recreational marijuana sales in New York on December 29, only 12 retailers have opened their doors. Among them, three are designated as “temporary delivery only,” which permits them to fulfill orders for up to one year from an office location.

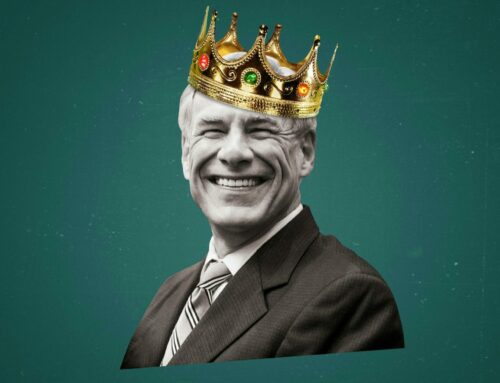

Approximately half of New York’s 1,520 municipalities have chosen to opt out of adult-use retail, including the majority of towns on Long Island, an area with high population density. The OCM’s proposal to allow MSOs to enter the market has generated both excitement and controversy in New York. Companies such as Curaleaf Holdings, Green Thumb Industries, and PharmaCann, which currently operate solely in the state’s medical marijuana market, are eager to make a bigger impact.

The proposed changes, expected to receive approval from the OCM following a public comment period, would eliminate the three-year waiting period for the state’s 10 vertically integrated medical marijuana providers, known as registered organizations (ROs), to enter the recreational market. The waiting period was originally put in place to give social equity retailers and smaller suppliers a first-to-market advantage. However, regulators have shifted their approach to expand retail channels and accelerate business.

While MSOs welcome the change, smaller operators feel overlooked. Annette Fernandez, an industry advocate and founder of La Casa Lola, a cannabis wellness brand in Manhattan’s Washington Heights neighborhood, expressed concerns about equity, stating, “There’s a lot of opportunity, but equity right now doesn’t feel achievable.”

Under the state’s waiver plan, MSOs will be required to pay multimillion-dollar, one-time fees to transition into the adult-use market. These fees will contribute to a Social Equity & Economic Plan approved by regulators on May 11. The plan pledges to provide workforce support, implement antitrust measures to prevent monopolization by larger companies, and promote “a broad diversity of ownership and improving market access for small, independent businesses.” However, the plan lacks specific details.

The recent developments, particularly the change regarding MSO entry, have raised concerns among some stakeholders. Nonetheless, these changes have also sparked efforts to revitalize the industry through grassroots initiatives and legislative overhauls. Jayson Tantalo, who played a role in establishing the New York CAURD Coalition (NYCC) for licensees and applicants, explained, “Nobody was expecting to see the regulations changed with the snap of a finger about the ROs entering the market, but it’s our job as coalition leaders to try to pivot and handle the situation accordingly.”

The NYCC, which consists of over 150 members, including a majority of the state’s 215 Conditional Adult-Use Retail Dispensary (CAURD) licensees, supports new legislation proposed by state Sen. Jeremy Cooney, aiming to revamp the regulated market. Senate Bill S7045, similar to the OCM proposal, would allow MSOs to convert three of their medical marijuana stores to recreational retail. However, they would be required to pay at least $20 million in one-time fees, paid in installments, exclusively funding “social and economic equity and incubator assistance.

Latest News

California Lawmakers Omit Cannabis Tax Relief from 2025 Budget

LOS ANGELES- California legislators did not include a freeze on the planned cannabis excise tax increase in the state’s 2025–26 budget, declining last-minute proposals to maintain the current 15% rate. The absence of this relief ...

AYR Wellness Delays Q1 2025 Filing

LOS ANGELES- AYR Wellness Inc. a vertically integrated multi-state cannabis operator in the U.S., has reported a delay in filing its interim financial statements, MD&A, and related CEO/CFO certification for the quarter ended March 31, ...

IM Cannabis Proposes $50 Million Mixed Securities Shelf to Bolster Funding

LOS ANGELES- IM Cannabis Corp. a Canada-based medical cannabis provider operating in Israel and Germany, has filed a registration statement for a mixed securities shelf worth up to USD 50 million. The filing, submitted June 26 to the ...