Canadian Cannabis Market Updates: A New Regulatory Shift in Ontario’s Cannabis Retail Landscape

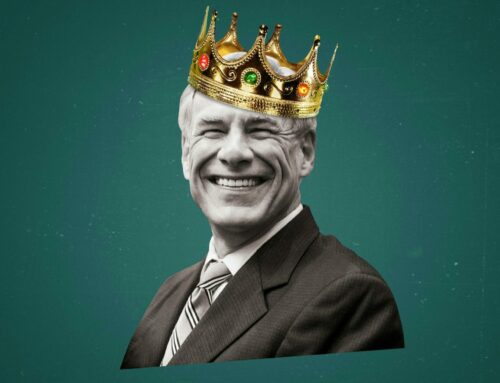

TORONTO- Announced on November 30 and implemented on January 1, Ontario’s cannabis market witnessed a significant policy change, allowing one company to operate up to 150 recreational cannabis stores—a notable increase from the previous cap of 75. This development, as reported by Solomon Israel for MJ Biz Daily, has sparked diverse reactions within the industry.

Lisa Bigioni, CEO and co-founder of the independent Ontario retailer Stok’d Cannabis, shared insights on how this regulatory change has been perceived. Contrary to some local media interpretations suggesting an overall increase in stores, Bigioni expressed skepticism, stating, “I don’t necessarily think that’s the case. I don’t think there’s really much room for that many more stores.” She highlighted the potential for smaller stores to be purchased, presenting both an opportunity and a challenge for independent retailers.

Shahbaaz Kara-Virani, co-founder of CannAcquire, noted the focus of major corporate cannabis retailers on selling low-cost marijuana at slim margins. This strategy, coupled with consolidation, could accelerate price compression in Canada’s competitive cannabis market, posing challenges for independent retailers.

Kara-Virani predicted a trend of significant consolidation in Ontario’s cannabis retail over the next six to 18 months. He emphasized that the new retail cap serves as a catalyst for mergers and acquisitions, potentially leading to a landscape dominated by five to six major players within three to five years.

While the increase in the cap benefits large corporate chains, concerns arise for independent retailers. The alleged impact of “data deals” further compounds challenges, with larger players leveraging their infrastructure and buying power to secure preferential treatment, making it harder for independents.

As the industry anticipates further consolidation, the increased ownership cap is expected to have varying effects on different players. Large corporate chains, including High Tide, see it as an opportunity to level the playing field, while independent retailers may face decisions about potential acquisitions or navigating the evolving market dynamics.

The dynamics of Ontario’s recreational marijuana market, currently valued at 177.7 million Canadian dollars ($133 million), coupled with the issuance of nearly 1,800 store licenses across the province, underscore the complexity of this evolving landscape.