IRS Reaffirms Enforcement of Section 280E Amid Cannabis Industry Pushback

MIAMI, Florida–In a recent announcement, the Internal Revenue Service (IRS) underscored the ongoing enforcement of Internal Revenue Code Section 280E, a tax code provision that has long been a contentious issue for cannabis businesses. The announcement comes amidst a wave of refund claims filed by cannabis operators, prompting a stern reminder from the IRS that these claims are not valid and will be addressed accordingly.

Background on Section 280E

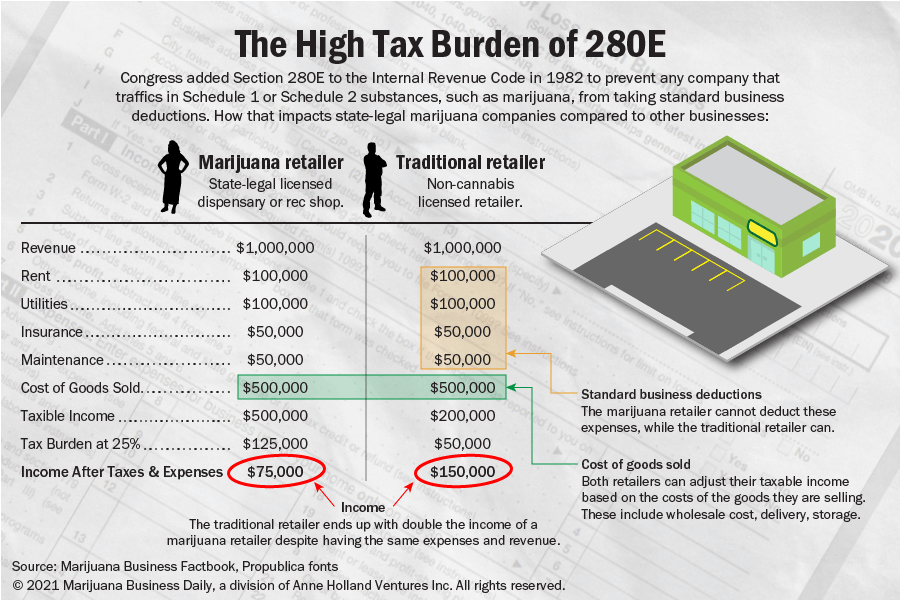

Section 280E was enacted in 1982 in response to a court case involving a drug dealer who claimed business deductions for expenses related to his illegal drug trade. The provision disallows deductions or credits for any amount paid or incurred in carrying on any trade or business that involves trafficking in controlled substances, as defined by the Controlled Substances Act (CSA). Cannabis, classified as a Schedule I substance under the CSA, falls squarely within this provision, regardless of state-level legalization.

An illustration from MJ Biz Daily on the impact of 280e.

The Industry’s Bet on Refund Claims

In recent years, some cannabis companies have taken a bold approach to challenging Section 280E by filing for refunds of taxes previously paid under this provision. Leading the charge was Trulieve, a prominent player in the cannabis industry, which inspired other companies like Curaleaf, Cresco Labs, and Green Thumb Industries to follow suit. The strategy was straightforward: file for a refund, and if the IRS challenges it through an audit, be prepared to repay the refund with interest. This interest rate, companies argued, would likely be lower than conventional financing costs, making it a cost-effective, albeit risky, short-term financial strategy.

Legal Opinions and Financial Implications

The cornerstone of this strategy lies in obtaining legal opinions from reputable law firms that suggest a reasonable basis for the refund claims. These opinions serve as a shield against penalties for underpayment of taxes, as having a third-party tax advisor’s backing implies that the filing was not frivolous. However, obtaining such opinions and defending the subsequent audits can be costly, making this approach feasible primarily for larger companies.

IRS’s Response

On June 28, 2024, the IRS issued a pointed reminder that cannabis remains a Schedule I controlled substance and is subject to the limitations of Section 280E. The IRS’s announcement emphasized that despite some taxpayers filing amended returns to seek refunds, these claims are not valid and will be addressed by the agency. The term “address” here carries a tone of imminent enforcement, signaling that the IRS is closely monitoring these developments and is prepared to take action.

The IRS’s reminder is particularly significant given the ongoing discussions about rescheduling cannabis under the CSA. On May 21, 2024, the Justice Department initiated a formal rulemaking process to consider rescheduling cannabis. However, until any final rule is published, cannabis remains a Schedule I substance, and the limitations of Section 280E continue to apply.

The Risks and Realities

For many in the cannabis industry, the gamble on refund claims is a calculated risk. The prospect of obtaining a significant cash infusion through refunds, even temporarily, can be enticing. However, the cost of defending an audit and the uncertainty of the outcome make this a high-stakes gamble. Tax courts have historically been unsympathetic to arguments against 280E, adding another layer of risk.

Moreover, this approach may not be suitable for smaller cannabis companies. Those with revenues under $25 million often resort to Section 471(c) to mitigate the impact of 280E, making the refund strategy less attractive.

Broader Implications

The IRS’s recent announcement serves as a cautionary tale for the cannabis industry. While innovative strategies to navigate the complex tax landscape are commendable, they must be grounded in legal and financial prudence. The industry’s hope that rescheduling cannabis might retroactively validate these refund claims adds another layer of complexity. Until any changes to the scheduling of cannabis are formally enacted, Section 280E remains a formidable challenge for cannabis businesses.

For further information, the IRS has made available a set of frequently asked questions and other resources related to the cannabis industry on its official website.