ANALYSIS: Germany’s Dual Medical Cannabis Market: A Tale of Two Systems

BERLIN- Since legalizing medical cannabis in 2017, Germany has built one of Europe’s most advanced frameworks for patient access. But today, two distinct markets dominate the scene: the slower-growing, regulated reimbursed segment and the dynamic, out-of-pocket private market.

1. The Public (Reimbursed) Market: Slow & Steady

The Gesetzliche Krankenversicherung (GKV) and its data arm GKV-GAMSi have just released full-year figures through 2024. These offer a clear picture:

-

€221 million in total medical cannabis reimbursement in 2024—a 5% rise from €209 million in 2023, and a steady increase from €198 million in 2022.

-

This publicly funded, prescribed-and-reimbursed segment serves as a stable, predictable pillar within the broader market.

Product breakdown:

| Category | 2024 Reimbursement |

|---|---|

| Dried cannabis flower | €103 million |

| Branded extracts (Canemes®, Epidyolex®, Sativex®) | €49 million |

| Other extracts (full-spectrum, dronabinol) | €68 million |

Despite being overshadowed by the booming private sector, the GKV-backed segment offers regulatory predictability and gradual, sustainable growth.

Fußballfans feiern am 26.06.2014 beim Fanfest in Hamburg während des WM-Gruppenspiels Deutschland gegen die USA das 1:0 für das deutsche Team. Das “Public Viewing” auf dem Heiligengeistfeld der Hansestadt gilt als eines der größten in Deutschland. Foto: Daniel Reinhardt/dpa +++(c) dpa – Bildfunk+++

2. The Private Market: Explosive but Unpredictable

In contrast, a vast majority of patients—up to 80% post-April 2024—are paying out of pocket for medical cannabis, avoiding the reimbursement maze. This segment is nimble, expansive, and often trend-driven.

While the public market added ~€12 million in 2024, total medical cannabis sales in Germany are projected to hit €420 million—well over double the GKV’s share—and forecast to exceed €1 billion by 2028.

3. Market Drivers & Regulatory Shifts

Several key factors are shaping both segments:

-

April 2024 legalization reforms (the Cannabis Act & MedCanG):

-

Broadened prescribing rights—allowing 16 medical specialties (e.g., GPs, neurologists, psychiatry) to write GKV-covered prescriptions without prior approval.

-

.Reclassified cannabis from strict narcotic status, streamlining distribution channels.

-

-

Surging imports and domestic supply expansion:

-

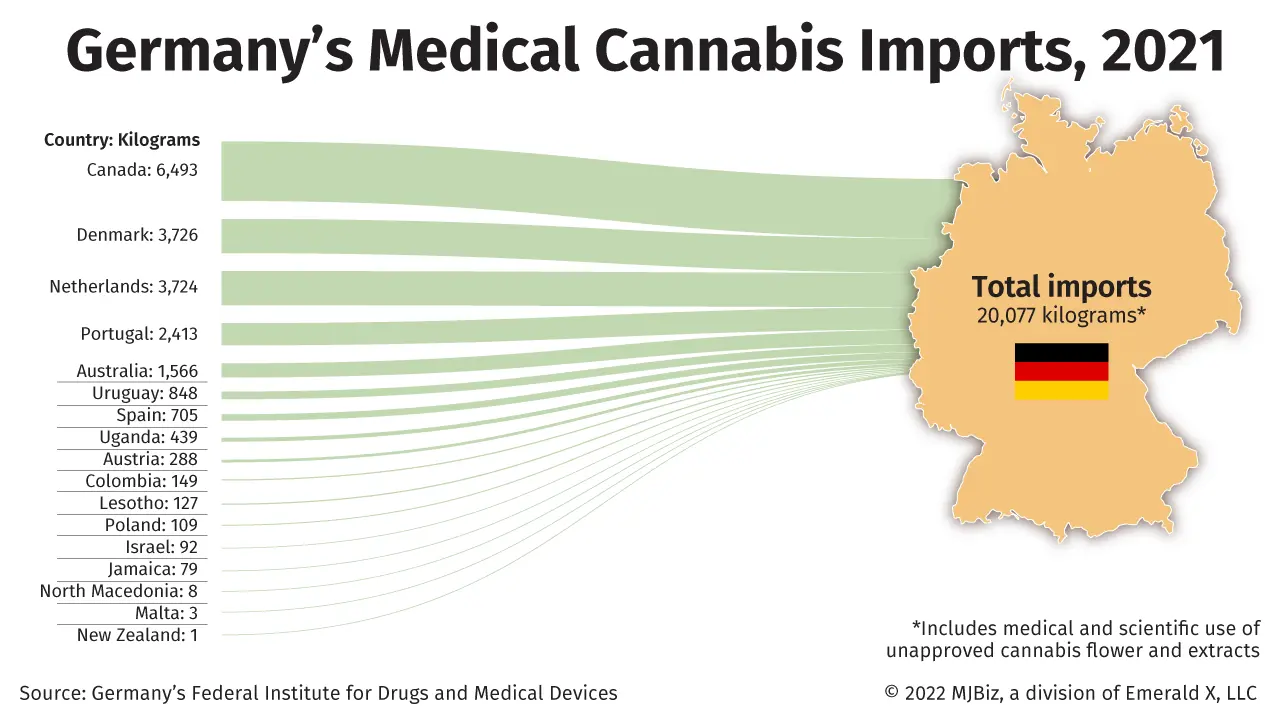

Imported cannabis quadrupled to ~11,705 kg in Q2 2024 post-law reform.

-

Domestic growers are entering the COMEDIEN cultivation licensure space, promising long-term supply autonom

-

4. Global Uniqueness of Germany’s Reimbursed Market

Few countries boast a publicly reimbursed medical cannabis system as robust as Germany’s. While others rely primarily on private-pay models, Germany’s GKV segment—€221 million strong—offers:

-

Insurance-backed stability

-

Structured patient pathways

-

A reliable baseline in a mixed market

It’s this hybrid posture—regulated public core plus a vibrant private frontier—that makes Germany’s approach globally distinctive.

5. Looking Ahead: Predictions for 2025–2028

Analysts forecast a compound annual growth rate (CAGR) over 14% for cannabis-related products, rising from roughly USD 37 million (≈€34 M) in 2024 to USD 86 million by 2030. Coupled with the €221 million reimbursed share, Germany’s total medical cannabis market is primed for continued expansion, driven by:

-

More streamlined GKV prescriptions

-

Technological advances in telemedicine

-

Increased cultivation and supply chain stability

Final Thoughts

Germany’s dual-market medical cannabis system—anchored by a stable, reimbursed GKV segment and fueled by a dynamic, private-pay sector—is charting a new blueprint. The GKV’s €221 million investment in 2024 not only underscores patient need but also affirms cannabis as a legitimate and essential component of modern healthcare.

In a global context, Germany’s model stands out: a publicly reimbursed market of this scale is rare. And as reforms continue to mature, the blend of regulation, innovation, and accessibility is setting a compelling precedent for medical cannabis integration worldwide.