Analysis: Cannabis Capital on the Rise: A Resilient Industry Continues To Grow

NEW YORK–Despite persistent regulatory frustrations, wholesale price compression, slowing growth, and historically low stock prices, the cannabis capital markets are showing unexpected strength.

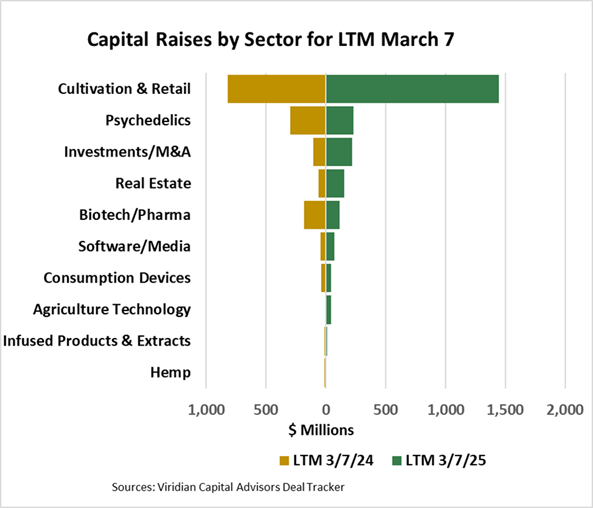

According to Viridian Capital Advisors, global cannabis capital raises surged to $2.3 billion for the last twelve months (LTM) ending March 7, 2025—a 46% increase compared to the prior year. This comes as a surprise to many, given the headwinds facing the industry. Notably, the United States accounted for 77% of total capital raised, a significant jump from 51% in the previous period.

While market uncertainty remains, this influx of capital suggests that investors are still willing to place strategic bets in key sectors.

Sector Performance: The Biggest Movers

Viridian’s Chart of the Week highlights capital raised across the top ten of twelve tracked industry sectors, with several seeing impressive year-over-year growth.

(Source: Viridian Capital Advisors)

📌 Cultivation & Retail – $1.44B raised (+76%)

- This sector remains the largest, making up 62% of all capital raised.

- The jump was primarily fueled by four major capital raises, three of which were debt refinancings:

- $215M for Ascend Wellness (OTCQX: AAHW)

- $150M for Green Thumb (CSE: GTII)

- $140M for TerrAscend (TSX: TSND)

- Additionally, Vireo Growth’s $82M private equity raise was the largest U.S. cannabis cultivation equity raise since May 2021.

📌 Investments & M&A – $216M raised (+109%)

- The standout deal here was the $212.5M IPO of Mercer Park Opportunities, the first cannabis SPAC IPO in years.

📌 Real Estate – $150M raised (+150%)

- The entire boost in this sector was driven by two debt raises by Chicago Atlantic.

📌 Ag Tech – $40M raised (+353%)

- The primary driver was Agrify (Nasdaq: AGFY), which raised around $35M.

📌 Consumption Devices – $112M raised (+12%)

- While not as dramatic as other sectors, this steady increase indicates continued investor interest.

Industry Outlook: What’s Next?

The increase in capital raises is an encouraging signal, suggesting that while challenges persist, investors are identifying pockets of opportunity. Debt refinancings are playing a key role, allowing established companies to optimize balance sheets and extend runway amid market uncertainties. Meanwhile, new equity raises—though fewer—indicate selective but meaningful capital inflows.

Looking ahead, several key factors will influence the industry’s capital markets:

✅ Regulatory clarity – Any movement on federal cannabis reform could drastically alter capital flows.

✅ M&A activity – Strategic consolidations are likely as companies seek operational efficiencies.

✅ Profitability focus – Investors are prioritizing financially sound companies with strong cash flow.

With cannabis growing in popularity by the day, the industry is now unstoppable despite conservatives at the state and federal either continuing to push back on the industry’s growth, or ignoring cannabis altogether.

(Source: Viridian Capital Advisors)

Link to Viridian’s Chart of the Week.)