U.S. Cannabis Operators Trail Canadian Counterparts in Valuation Metrics, Tied to Tax Constraints

LOS ANGELES – In the ongoing tug-of-war between regulatory challenges and market potential in the Cannabis sector, a fresh analysis underscores how a longstanding IRS provision continues to weigh on American companies.

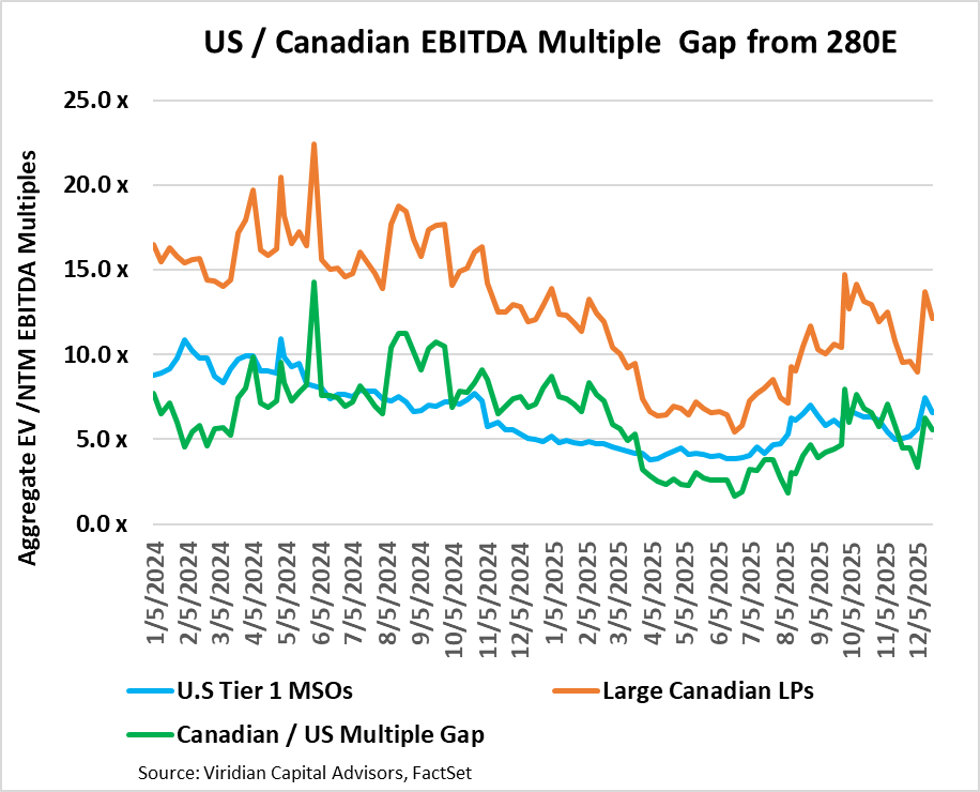

According to Viridian Capital Advisors’ latest Chart of the Week, the disparity in enterprise value-to-EBITDA multiples between top U.S. multi-state operators (MSOs) and their Canadian licensed producer (LP) peers has widened to 5.5 turns, a chasm primarily carved out by Section 280E of the tax code.

This rule bars Cannabis businesses from deducting ordinary expenses against revenue, effectively eroding much of their EBITDA into reduced free cash flow. Viridian’s data plots Canadian LPs trading at an average 12.1x next-12-month EBITDA, reflected in an orange trend line, while U.S. top MSOs hover at 6.6x, marked in blue. The resulting green gap line highlights the drag: for every dollar of reported EBITDA among U.S. firms, a significant portion dissipates under tax pressures that Canadian operators largely avoid.

The setup distorts core metrics that investors rely on for comparability. EBITDA multiples serve as a proxy for operational efficiency and growth prospects, but 280E inflates effective tax rates compressing net profitability and deterring capital deployment. If repealed, as momentum builds through proposals like the SAFER Banking Act, U.S. multiples could realistically climb toward 15x or higher.

That projection aligns with the sector’s fundamentals. American MSOs tap into a consumer base nine times larger than Canada’s, boast superior margins in mature markets, and stand to gain from streamlined banking and interstate commerce reforms. A jump to 15x would imply a near-doubling of enterprise values for the group, unlocking roughly $10 billion in additional market capitalization based on current aggregate EBITDA of about $1.5 billion.

Such a valuation reset would ripple through dealmaking. With equities currently undervalued, MSOs have shied away from stock-swap acquisitions to avoid shareholder dilution; elevated multiples would flip that dynamic, making mergers more attractive. Coupled with fatter cash flows, potentially adding 20-30% to free cash generation post-280E, these firms could expand borrowing headroom, fueling a pickup in consolidations. Viridian anticipates this won’t recapture the frenzy of 2021’s $20 billion M&A volume but could lift activity from the subdued $2 billion pace of the past two years.

Equity markets, dormant amid reform gridlock, might also stir. Operators could tap fresh capital to swap out high-cost debt or ramp up facility builds, bolstering balance sheets strained by years of capex restraint.

For investors observing the Сannabis space, the math is compelling yet contingent. Regulatory relief remains a congressional coin flip, vulnerable to election-year politics, and even without 280E, broader economic headwinds like interest rates could cap upside. Still, the current discount embeds a bargain for those betting on policy progress.

This valuation rift is not an anomaly but as a stark reminder of untapped scale in the U.S. Cannabis market. Resolving it could finally align American operators with their global benchmarks, propelling the sector from survival mode into sustainable expansion, and rewarding the patience of stakeholders who have weathered through countless political and regulatory storms.

Source: Viridian Capital Advisors