Viridian Capital Advisors Reports Valuation Metrics for U.S. MSOs with Market Caps >$100M

LOS ANGELES – Multi-state cannabis operators in the United States are carrying valuation multiples that signal caution among investors, even as growth prospects brighten for the coming year.

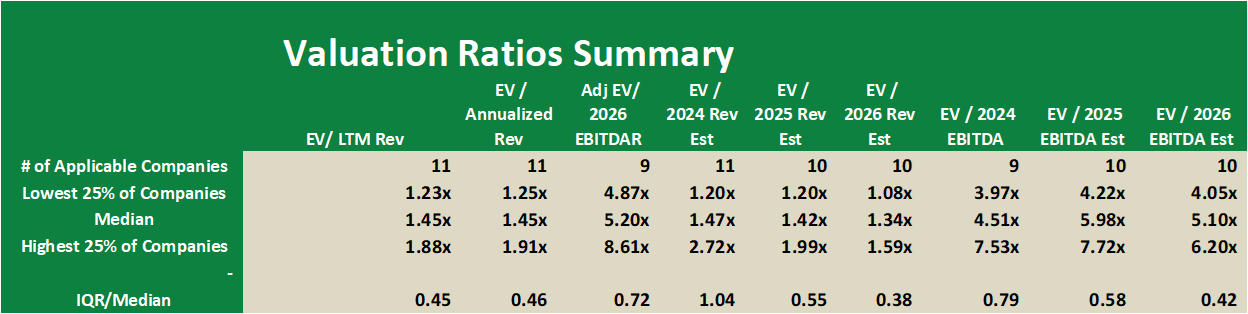

According to a fresh Weekly Valuation Report from Viridian Capital Advisors, the 11 publicly traded MSOs with market capitalizations exceeding $100 million posted a median enterprise value to 2026 earnings before interest, taxes, depreciation and amortization (EV/EBITDA) ratio of 5.1x. Viridian’s adjusted metric, which factors in excess tax liabilities and operating leases to yield an enterprise value to earnings before interest, taxes, depreciation, amortization and rent (EV/EBITDAR), came in slightly higher at 5.72x.

These figures reflect both the Cannabis equity market and the Cannabis capital market grappling with persistent questions over federal policy changes. Cannabis stocks surged early last week on reports of a potential hemp industry clampdown, with traders betting that restricted hemp sales would redirect dollars to traditional Cannabis channels. That optimism faded midweek after details emerged of a one-year implementation delay and skepticism about recapturing lost revenue streams.

From a financial perspective, these multiples look compelling relative to historical norms for the sector, where ratios often climbed above 10x during peak enthusiasm periods. At current levels, the implied pricing embeds a healthy margin of safety, assuming projected revenue acceleration materializes. Viridian forecasts a rebound in top-line growth for 2026, driven by ballot initiatives and legislative pushes in states like Florida, North Dakota, and Pennsylvania that could unlock recreational markets. Yet the numbers also price in downside risks: ongoing tax burdens under Section 280E, competitive pressures from illicit markets, and the slim odds of near-term federal rescheduling.

The prospect of the Drug Enforcement Administration moving Cannabis to Schedule III remains a wildcard that could ignite a 50-100% rally across the board, much like past reform teases. But with capital markets still tight [evidenced by sparse debt issuances and equity offerings] operators face pressure to deliver operational efficiencies in the interim.

As Cannabis industry watchers, here at Highly Capitalized Network-HCN, we view these valuations not as a bargain basement fire sale, but as a measured bet on policy progress. Investors who weather the current chop, stand to gain from a sector poised for consolidation and expansion, provided Washington delivers more than rhetoric. In the end, the real yield will come from those who pair patience with rigorous due diligence, turning regulatory fog into portfolio alpha.

Source: Viridian Capital Advisors