Cannabis Stocks Rally but Remain Undervalued Relative to Peers, Viridian Report Finds

LOS ANGELES – U.S. Cannabis companies have posted impressive gains this year, yet their valuations still trail those of comparable industries, a new analysis from Viridian Capital Advisors indicates.

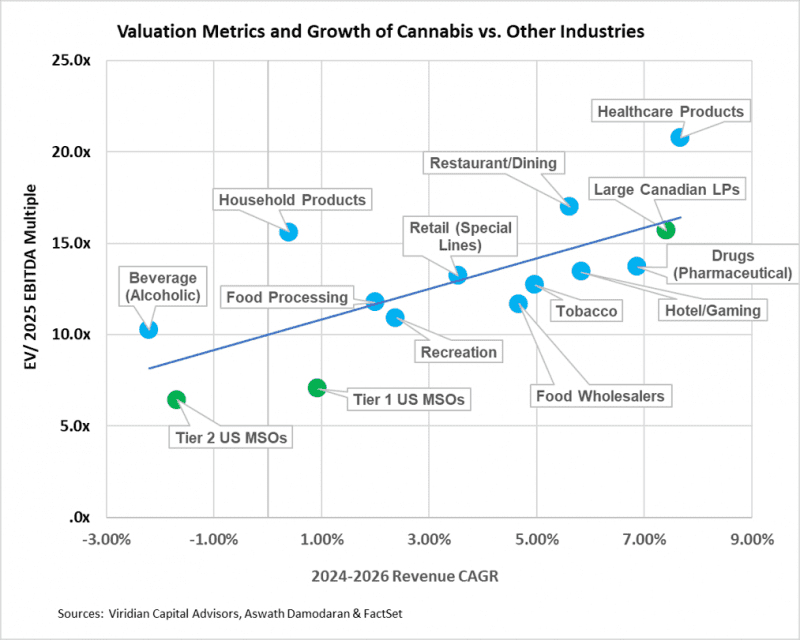

The Weekly Chart by Viridian plots enterprise value multiples based on 2025 earnings before interest, taxes, depreciation, and amortization (EBITDA) against expected revenue growth from 2024 to 2026. Drawing on data from 260 companies across 14 sectors, modeled after frameworks from NYU finance professor Aswath Damodaran, it highlights persistent discounts for American multi-state operators (MSOs).

Shares in the sector, as gauged by the MSOS exchange-traded fund, have surged 57% year-to-date through late August. That far exceeds the S&P 500’s roughly 8 percent return over the same period. Even so, leading U.S. companies, categorized as Tier 1, trade at just 7 times projected 2025 EBITDA, up from about 4 times in January but well below benchmarks in tobacco, pharmaceuticals, and healthcare products.

This discrepancy holds despite strong profitability metrics. Tier 1 operators project a 27% EBITDA margin next year, placing them fourth among the groups studied, behind tobacco at 49%, pharmaceuticals at 40%, and healthcare products at 28%. Expected revenue growth has dipped, however, to under 1& annually through 2026, reflecting market headwinds like competition and state-level saturation.

Viridian points to federal hurdles as a core issue. Section 280E of the tax code denies standard deductions to Cannabis businesses, inflating their effective tax burdens. A rough adjustment for this, scaling EBITDA down by 30%, lifts the implied multiple to about 10 times, yet that still falls short of regression-line predictions derived from the broader data set.

Liquidity constraints add another layer. Many U.S. Cannabis stocks list on over-the-counter markets, limiting investor access and trading volume. By contrast, large Canadian licensed producers, which enjoy fuller exchange listings, command multiples above 15 times and align more closely with fair-value estimates.

The rally stems largely from optimism over potential rescheduling of Cannabis to Schedule III under the Controlled Substances Act. Viridian estimates this shift could boost Tier 1 multiples by three points by easing taxes and operational restrictions. Still, the firm cautions that comprehensive uplift demands more: reforms to allow banking services and perhaps explicit guidance from the Attorney General to clarify enforcement.

From a broader financial perspective, this setup reveals a sector caught between promise and policy paralysis. Multiples this low, paired with margins rivaling established industries, signal deep-seated investor skepticism rooted in regulatory risk. Yet the embedded upside is substantial (if deregulation materializes), it could catalyze a re-rating toward pharmaceutical-like valuations, rewarding those betting on federal momentum. Absent that, flat growth trajectories may sustain the discounts, testing the patience of shareholders amid ongoing capital constraints.

The takeaway is straightforward: true sector maturity hinges on Washington delivering tangible change, transforming today’s bargains into tomorrow’s benchmarks without further delay.

Source: Viridian Capital Advisors