Canada’s Cannabis Industry Defies Economic Odds

TORONTO – In a striking contrast to Canada’s faltering economy, the legal Cannabis industry continues to flourish, bolstering the nation’s GDP while other sectors struggle. Statistics Canada reports that the licensed cannabis sector grew by 0.63% in May 2025, contributing $9.28 billion to the GDP, even as the country’s real GDP dipped by 0.1% for the second straight month. This resilience highlights Cannabis as a key economic driver amid broader challenges.

The retail trade sector contracted by 1.2% in May, yet licensed Cannabis retail defied the trend, surging 1.9% and adding just over $1 billion to the GDP. Similarly, while crop production fell by 0.94%, licensed Cannabis production rose by 0.47%, contributing nearly $8.3 billion. Total Cannabis sales hit a seasonally adjusted $482.3 million in May, eclipsing the previous high of $468.8 million from December 2024, with unadjusted sales reaching $485.4 million.

Since legalization in October 2018, adjusted sales have amassed $25.2 billion.

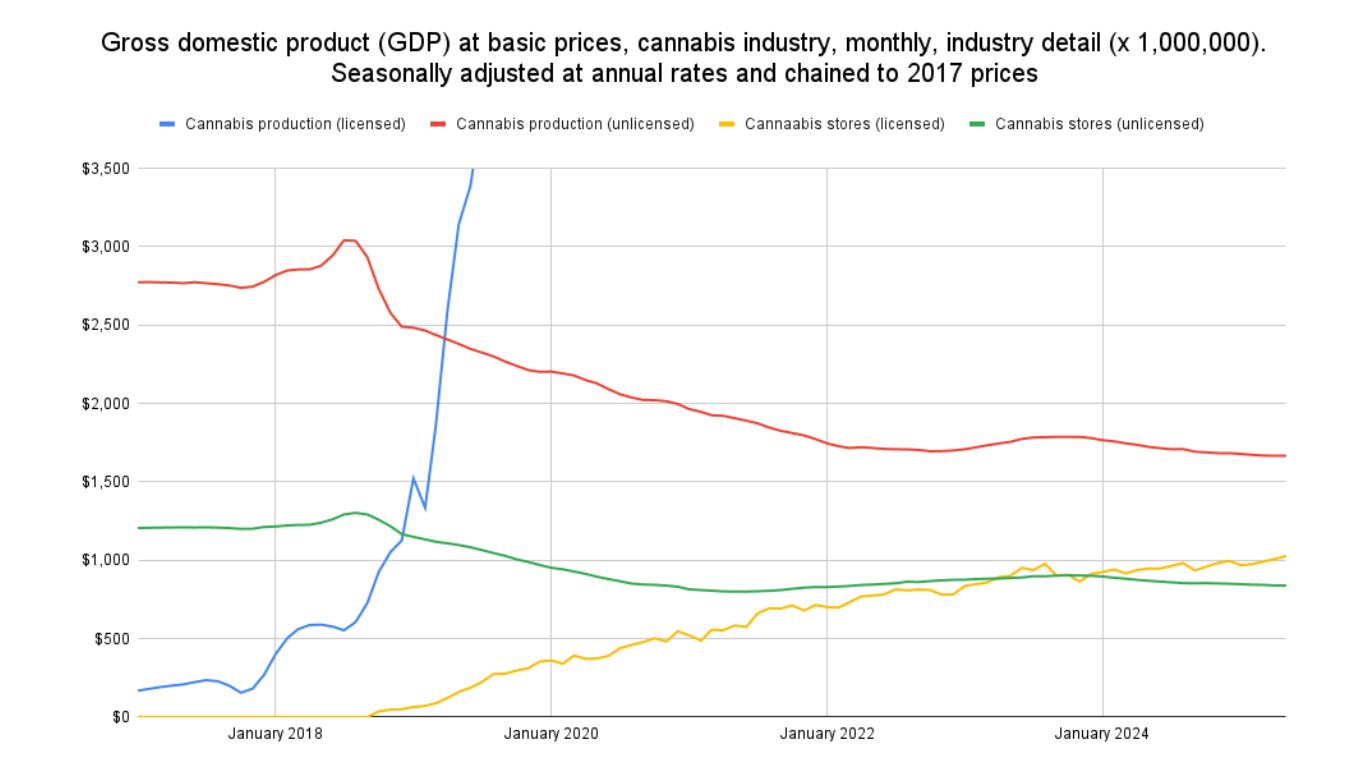

The legal Cannabis market continues to erode the unlicensed sector’s share. Licensed production surpassed illicit production’s GDP contribution by April 2019, and licensed retail overtook unlicensed retail in April 2023, solidifying its dominance by December 2024. While the illicit market has stabilized since early 2022, showing modest gains, its GDP contribution remains significantly lower, at $2.6 billion in 2024.

Market trends reveal shifting consumer preferences. Dried flower remains dominant in both medical and non-medical markets but is losing share to concentrates, which are gaining traction, while edibles have seen a slight decline. With the industry sustaining 151,000 jobs and generating $15.1 billion in tax revenue since legalization, Cannabis continues to prove its economic mettle.