Cannabis Giants Grapple with Weak ROIC, Viridian Report Finds

LOS ANGELES – A recent analysis by Viridian Capital Advisors paints a somber picture for the Cannabis industry, projecting that none [!] of the 11 major companies studied will achieve a Return on Invested Capital (ROIC) exceeding their Weighted Average Cost of Capital (WACC) in 2025. This gap signals potential value destruction for investors, as companies struggle with low operating margins and poor capital efficiency.

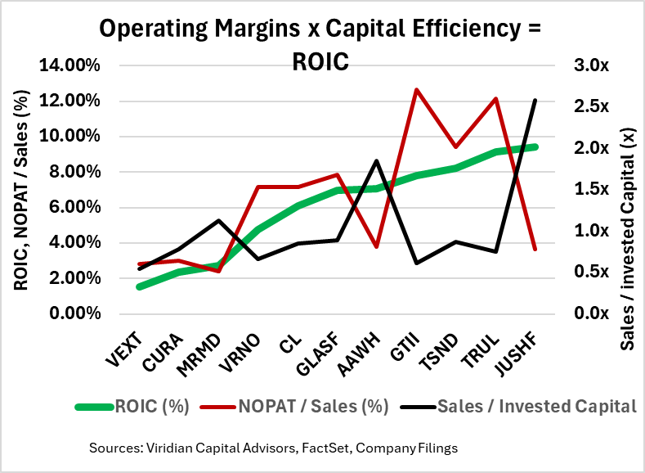

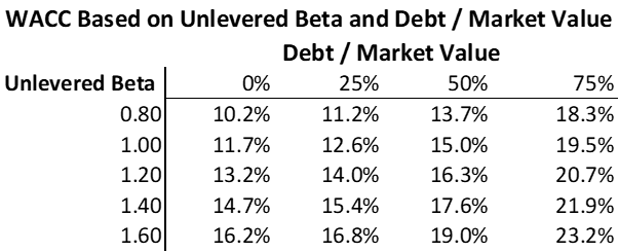

The report calculates 2025 ROIC by deriving Net Operating Profit After Tax (NOPAT) from consensus estimates of operating income, adjusted with an optimistic 25% tax rate, assuming the resolution of IRS Code 280E, which restricts tax deductions for cannabis businesses. ROIC figures range from a low of 1.53% for Vext Science (VEXT: CSE) to a high of 9.40% for Jushi (JUSH: CSE). However, all fall short of their respective WACCs, calculated using the Capital Asset Pricing Model with a 4.22% risk-free rate, a 4.48% market risk premium, a 3% Cannabis risk premium, and debt rates between 10% and 22%.

The analysis highlights two key issues: shrinking operating margins and inefficient capital use. Top performers like Green Thumb Industries (12.6%), TerrAscend (9.4%), and Trulieve (12.2%) project the highest after-tax operating margins, but these remain below 2024 levels. More critically, the industry’s average Sales/Invested Capital ratio is a mere 0.80x, meaning $1.25 in capital is needed for every dollar of sales, a level unsustainable given current profitability. Jushi stands out as the only company requiring less than $1 of capital per dollar of sales.

Viridian points to intrastate consolidation in markets like Missouri and Michigan, alongside the closure of costly cultivation sites, as steps toward improved efficiency. Long-term, interstate commerce could drive significant capacity consolidation, boosting ROIC and enabling larger players to dominate.

As the Cannabis sector navigates these challenges, strategic consolidation and operational streamlining will be critical for survival. For an industry still finding its footing, the path to sustainable profitability lies in smarter capital allocation and a leaner, more efficient future.

Source: Viridian Capital Advisors