Cannabis Real Estate Valuations Highlight Sector Dynamics

LOS ANGELES – A recent report from Viridian Capital Advisors sheds light on the valuations of four key players in the U.S. Cannabis real estate sector: Chicago Atlantic and AFC Gamma, the leading specialty lenders, and NewLake Capital and Innovative Industrial Properties (IIPR), the top sales-leaseback providers. These companies, critical to the infrastructure of Cannabis operations, showcase distinct business models and financial profiles that reflect broader market trends.

Sales-leaseback providers like NewLake and IIPR own the real estate assets leased to multi-state operators (MSOs) and single-state operators (SSOs). Their leases, often spanning over 15 years with annual rent escalations of approximately 3%, provide stable, long-term revenue streams. In contrast, Chicago Atlantic and AFC Gamma focus on shorter-term secured lending, with loan durations typically ranging from three to five years, catering to the immediate capital needs of Cannabis businesses.

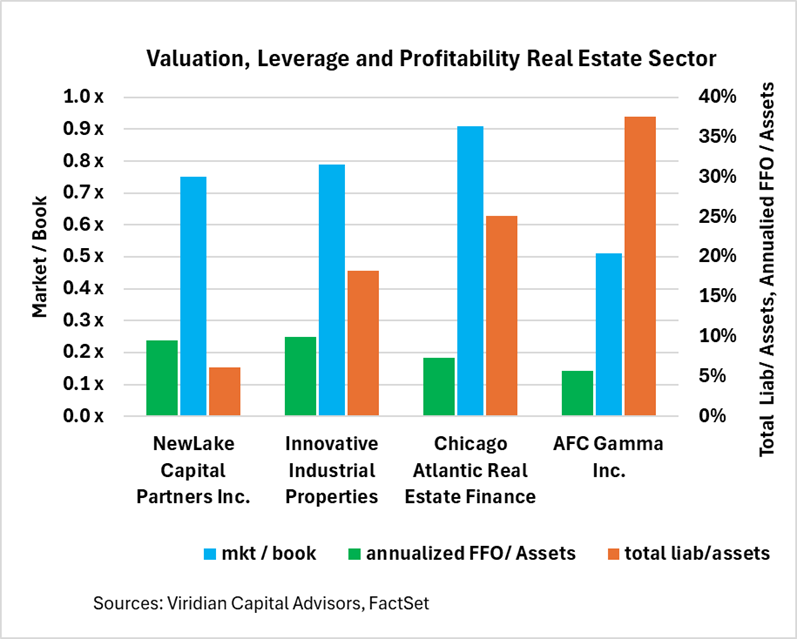

According to Viridian’s latest Valuation Tracker, NewLake Capital stands out with the second-lowest market-to-book ratio among the group, despite boasting lower leverage (total liabilities to assets) and one of the highest profit margins, as measured by annualized funds from operations (FFO) to assets. This suggests an undervaluation relative to its financial strength, potentially signaling an opportunity for investors in a sector hungry for stable returns.

AFC Gamma, however, presents a different story. With the lowest market-to-book ratio, its valuation reflects challenges tied to lower profitability and higher leverage. This contrast underscores the diverse risk-reward profiles within Cannabis real estate, where leverage and profitability play pivotal roles in shaping investor perceptions.

These valuation dynamics highlight the delicate balance between risk and opportunity. Firms like NewLake and IIPR, with their long-term, asset-backed models, offer stability in a volatile market, while lenders like Chicago Atlantic and AFC Gamma fuel growth but face greater exposure to short-term risks. For investors, understanding these nuances is crucial to navigating a sector where innovation and capital are reshaping the future of Cannabis commerce.

Source: Viridian Capital Advisors