US Cannabis Industry Poised to Top $123 Billion Economic Impact in 2025

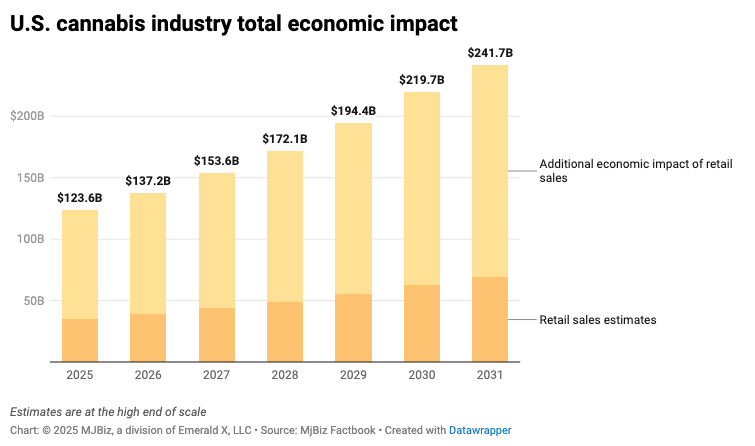

LOS ANGELES–Despite mounting challenges, the U.S. cannabis industry is on track to generate a staggering $123.6 billion in total economic impact in 2025, according to new projections from the MJBiz Factbook. That’s a 9% increase over 2024 – a testament to the sector’s resilience amid federal inaction and headwinds from economic uncertainty.

While legacy markets like California and Colorado face stagnation or decline, momentum from newer adult-use states such as New York and Ohio is helping to stabilize the national picture. The MJBiz analysis also forecasts that by 2030, cannabis could pump more than $200 billion annually into the U.S. economy.

Strong Growth, Weak Reform

Direct sales of medical and adult-use cannabis are projected to reach $35.3 billion in 2025, with an additional $88.3 billion generated indirectly through supporting industries like agriculture, manufacturing, real estate, events, and professional services.

Yet, the industry’s growth continues to outpace its policy support. In 2024, cannabis operators saw hopes dashed for major federal reform. The DEA has stalled on rescheduling, Congress failed to pass banking or legalization bills, and voters in key states – most notably Florida – rejected adult-use measures, despite nearly $150 million in campaign spending.

With the political climate shifting, particularly under a Trump administration focused on tariffs and government spending cuts, insiders see little chance of meaningful regulatory change in 2025.

Regional Shifts and Resilient Demand

Cannabis is now legally available for adult use in 24 states. Markets such as Minnesota are set to come online, while the East Coast continues to develop. New York and Ohio, in particular, are expected to see strong growth as their regulatory frameworks mature.

In contrast, Western markets that once defined the industry are contending with oversupply, pricing pressure, and slowing consumer demand. However, some stabilization is occurring, especially in Colorado, where saturation may have hit a natural ceiling.

One wild card remains: the broader economy. Should the U.S. enter a recession in 2025, discretionary cannabis spending – particularly in emerging markets – could be affected.

Cannabis as a Catalyst for Broader Economic Activity

The MJBiz Factbook underscores that cannabis isn’t just about dispensaries and cultivation. Every dollar spent at a cannabis retailer or medical dispensary generates an additional $2.50 in economic activity, according to standard multiplier models.

That ripple effect touches sectors as varied as real estate, construction, professional services, events, and hospitality. Cannabis workers spend on local goods and services, businesses invest in infrastructure, and tax revenues fund essential government programs like schools, roads, and public health initiatives.

Even indirect cannabis businesses – from lighting manufacturers to HR consultants – play a role in sustaining this ecosystem.

Data-Driven Growth Insights

The latest MJBiz Factbook, now available by subscription, offers a deep dive into these trends. Its first quarterly update for 2025 spans 156 pages, covering licensing dynamics, public market activity, M&A trends, and a state-by-state market guide.

Published by MJBizDaily since 2011, the Factbook has become a cornerstone resource for cannabis operators, investors, and policymakers seeking actionable intelligence in a fast-evolving industry.

As the cannabis economy continues to grow – with or without Washington’s help – one thing is clear: the plant’s economic footprint is no longer niche. It’s national.