California’s Cannabis Industry Faces Meltdown as New Tax Hike Begins

LOS ANGELES – California’s legal cannabis industry is sounding the alarm as a significant excise tax increase, which took effect on July 1, 2025, threatens to cripple an already struggling market. The excise tax on legal cannabis has risen from 15% to 19%, a move that industry leaders, including growers, dispensary owners, and advocates, warn could drive consumers to the illicit market and potentially devastate legal businesses. Despite a robust campaign to suspend the hike, supported by Governor Gavin Newsom and other political leaders, the tax increase was not blocked in the state budget passed in June, leaving the industry bracing for consequences.

The tax hike stems from a political deal made three years ago, intended to provide temporary relief for the legal cannabis market by removing a cultivation tax while mandating future excise tax adjustments if revenues declined. However, with taxable cannabis sales dropping to $1.09 billion in the first quarter of 2025, a 30% decline from their peak in early 2021, the industry argues that the increased tax burden exacerbates existing challenges.

“I’ve never experienced collective malaise like this,” said Genine Coleman, founder of the Origins Council, a Ukiah-based nonprofit representing small farmers in Northern California’s Emerald Triangle, encompassing Mendocino, Humboldt, and Trinity counties. “People are so concerned with their survival and so deflated. It’s a dangerous space.”

Industry Struggles Amid Overproduction and Illicit Competition

Since California voters legalized recreational cannabis through Proposition 64 in 2016, the legal market has faced significant hurdles. Overproduction has led to a sharp decline in cannabis prices, while restrictive local regulations have limited retail access, with many cities and counties prohibiting dispensaries. According to the California Department of Cannabis Control, legal sales account for less than 40% of cannabis consumption in the state, as high taxes (combining state excise and local sales taxes) can inflate consumer prices by up to a third. This price disparity drives consumers to the unregulated illicit market, which offers cheaper alternatives without the tax burden.

Industry representatives argue that the 19% excise tax, effective July 1, 2025, will further deter consumers from legal purchases.

“The math isn’t there,” said Amy O’Gorman Jenkins, executive director and lobbyist for the California Cannabis Operators Association. “We have no objections to how cannabis tax revenues are being spent. All we’re maintaining is that you can’t squeeze blood from a stone.” Jenkins and others warn that the tax hike could reduce legal sales further, paradoxically lowering tax revenue as consumers turn to illegal sources.

Legislative Efforts and Budget Shortfall Concerns

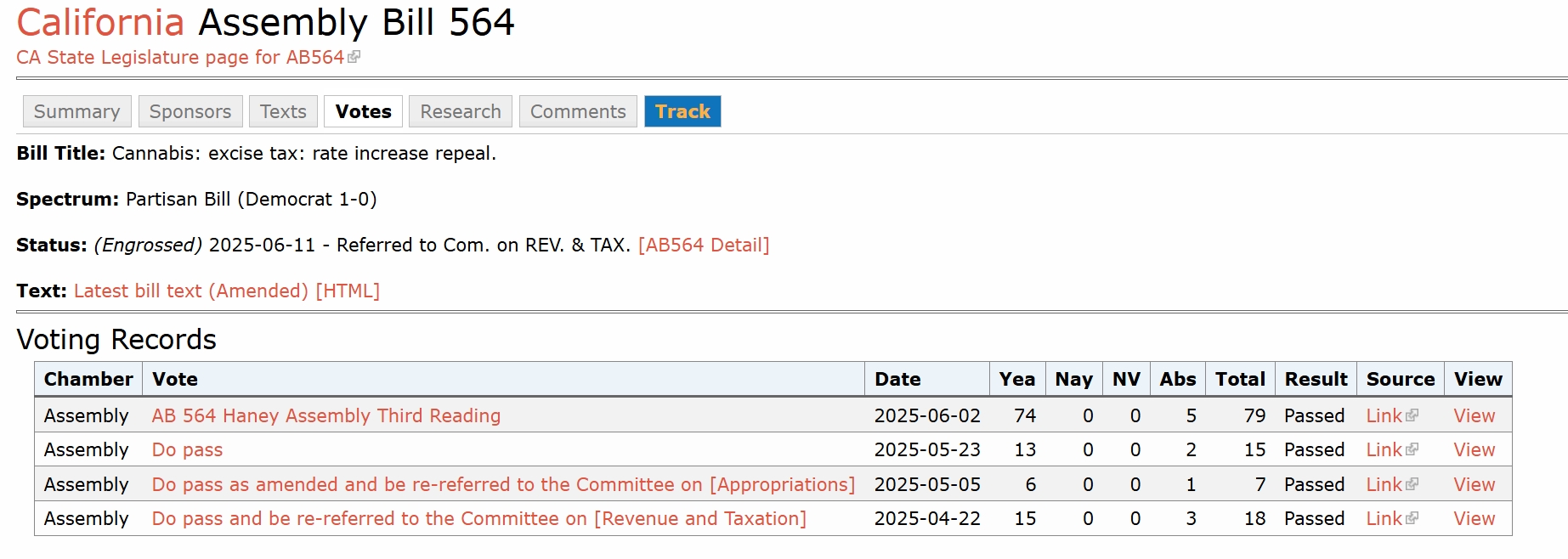

The industry’s push to freeze the tax increase gained significant traction, with Assembly Bill 564, introduced by San Francisco Democrat Assembly member Matt Haney, proposing to maintain the 15% excise tax rate through June 2031.

The bill passed the Assembly unanimously in May 2025 and is currently under consideration in the Senate. However, the Senate’s decision to allow the tax hike to proceed has sparked frustration. “This tax could kill this industry, and there’s still not enough being done,” Haney said. “California is going to forfeit what should have been a huge opportunity for our state.” He criticized the Senate for sending a message that undermines incentives for legal cannabis operators to comply with regulations.

Opponents of a tax freeze, including some lawmakers, highlight that maintaining the 15% rate would create a budget shortfall, impacting community programs funded by cannabis tax dollars, such as youth initiatives and law enforcement. State analysts estimate the 19% tax could generate an additional $180 million annually, a critical sum amid California’s budget constraints. However, industry advocates counter that higher taxes may reduce legal sales, ultimately decreasing overall tax revenue as the illicit market grows.

Looking Ahead

Despite the setback, industry advocates remain hopeful that Assembly Bill 564 will gain Senate approval and reverse the tax hike. However, repealing the increase now that it has taken effect poses significant challenges. Cannabis operators continue to rally, emphasizing that the legal market’s survival depends on competitive pricing and regulatory support.

“More businesses will close sooner as the legal price is just too far away from illegally obtained products,” said Jerred Kiloh, president of the United Cannabis Business Association (UCBA). “Less investment in starting or continuing cannabis operations will occur, and demand for cannabis licenses will decline exponentially.”

As California grapples with balancing fiscal needs and industry sustainability, the debate over cannabis taxation underscores broader questions about the state’s ability to nurture a legal market envisioned as a national leader. For now, local cannabis operators are left to navigate a precarious landscape, hoping for legislative relief before the tax increase takes effect.