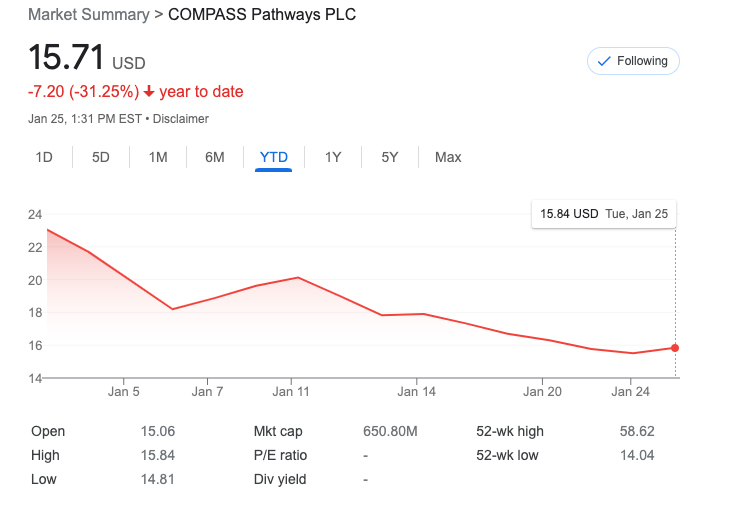

Compass Pathways Stock is Having a Bad Trip Despite Positive Psilocybin Trial Results

LOS ANGELES – Although Compass Pathways reported favorable findings in a depression trial last year, the company’s stock plummeted late last year as investors presumably had already expected that result, and thus could be simply taking profits by selling their shares.

The goal of the Compass Pathway trial, whose results were released in November of last year, was to determine the appropriate dose amount for a larger Phase 3 trial that will begin sometime this year. The trial’s primary goal was to examine if 25 mg of Comp360 might prevent treatment-resistant depression after three weeks. The secondary endpoint focused on its impacts throughout a 12-month period.

Even though the London-based psychedelic-drug researcher stated a large dose of its psilocybin-based medicine helped lessen depression in treatment-resistant patients after three weeks in a Phase 2b trial, Compass Pathways stock was hammered then, and still continues to slide further.

Compass, which is financed by billionaire businessman Peter Thiel, has been attempting to assess the medication’s effectiveness in treating treatment-resistant depression patients. Treatment-resistant depression is defined as depression that persists despite receiving at least two antidepressant medications.

(Peter Thiel a founder of PayPal)

What happened? Last year, the company released the results of this Phase 2B study of Compass Pathways’ Comp360 medication. Comp360 is a synthetic, crystalline form of psilocybin taken as an oral capsule.

The capsule was taken in a protocol featuring music headphones and an hours-long song playlist of mostly classical music. The results showed a “highly statistically significant and clinically relevant reduction” in depression-symptom severity over a 12 week time period, according to the company.

The COMP360 findings are the most recent to suggest that psychedelics, especially Psilocybin, may have potential. However, investors have noticed that the barriers for entry for Psilocybin based products are relatively low, as the natural mushroom version of COMP360 grows freely in forests and fields.

Perhaps too, investors worry about COMPASS Pathways cash burn. While the company has a healthy cash runway, its cash burn trend may have some investors wondering when the business may need to raise further funds.

According to Zacks Investment Research, analysts predict COMPASS Pathways plc (NASDAQ:CMPS) to earn ($0.48) per share in the current quarter.

The best EPS (earnings per share) estimate coming in at ($0.46) and the lowest estimate coming in at ($0.51).

COMPASS Pathways reported ($0.52) in earnings per share in the same quarter last year, implying a 7.7% year-over-year increase.

On Tuesday, March 8th, the company will release its next earnings report.

Analysts predict that, in the coming year, the stock could well rebound due to results from the stage 3 trial currently being contemplated for later in 2022.

In 2018, the FDA designated Compass’s Comp360 treatment regimen as a breakthrough therapy. Johnson & Johnson’s (JNJ) Spravato, which employs a ketamine derivative, also has been approved by the FDA for treatment-resistant depression and anxiety.

However, unlike Ketamine which is dangerous and could cause death, Psilocybin is non toxic and can be safely consumed by humans if they are in a safe setting.

Only time will tell which psychedelic medicine and treatment regimens will succeed, until then those companies pursuing Psilocybin as a psychedelic medicine, will have a hard road ahead of them, in patenting all mother natures’ hundreds of compounds and molecules found in ”magic mushrooms.”