UCASU saved on cannabis property’s target price by 60% through due diligence

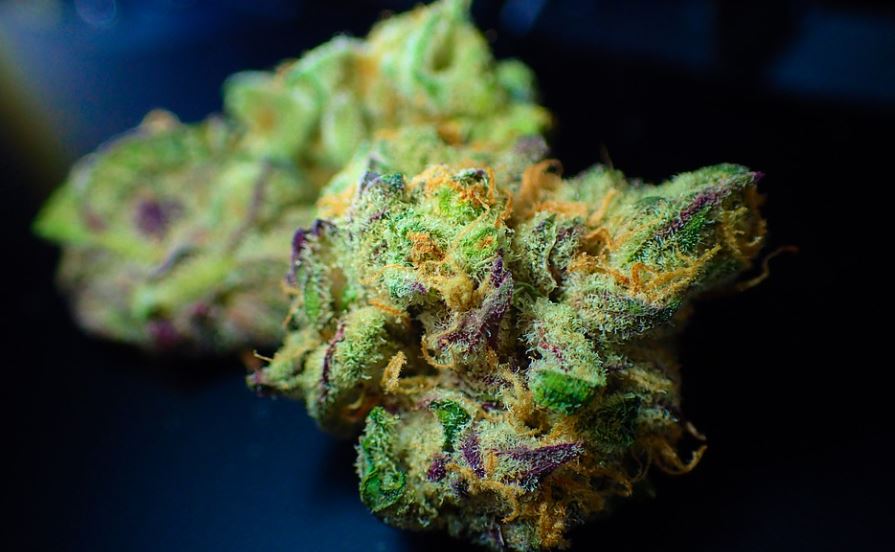

ATLANTA – UC Asset LP (OTCQX: UCASU) announced the company’s management team has just concluded the phase I due diligence on a piece of cannabis property in Oklahoma, and already reduced the target price by almost 60%.

“Our LOI with the seller, came into effect on December 6, gave us 60 days to conduct our due diligence,” explains Greg Bankston, managing general partner of UC Asset. “Last week our management team traveled to Oklahoma for a thorough on-site inspection. Based on our findings, we successfully challenged its revenue projection, which leads to us convincing the seller to reduce the target price to $900,000, from the original asking price of $2.2 million.”

Bankston confirms UC Asset may request further reduction of the purchase price, depending on the findings of its due diligence in the coming weeks.

“Our management’s goal is to acquire the best properties at best prices,” says Larry Wu, founder of UC Asset. “Our company’s acquisition strategy includes applying a high standard of due diligence on any target acquisitions, in an effort to protect the interest of our investors.”

If UC Asset acquires the property, the firm will lease the property to licensed growers, implementing a business model similar to those of established public companies, such as Power REIT (NYSE: PW). In February 2020, Power REIT announced expanding its portfolio in greenhouses for both food and cannabis cultivation. In less than 2 years since this announcement, its stock price has soared from $8.45 (February 03,2020) to $63.10 (December 10, 2021), an increase of 750%.

With a goal to replicate Power REIT’s success, UC Asset has developed a pipeline of deals of cannabis properties. Bankston confirms that the company has located another similar property in Oklahoma, a number of properties in California, as well as opportunities in Georgia the firm’s home state.

The company has also entered into an umbrella LOI deal to invest into cannabis properties operated by OTC company PURA Inc (OTC: PURA).

“Our team is extremely excited about the upcoming year,” exclaims Bankston. “We are working round the clock to bring the best out of these deals. Our ultimate goal is to secure properties that will allow us to join Power REIT and a select group of other forward-thinking investors, as trendsetters in providing opportunity for cannabis cultivation while creating remarkable profit for our investors.”

Disclaimer:

This News Release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any these statements. You are cautioned not to place undue reliance on any those forward-looking statements. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements after the date of this news release. None of such forward-looking statements should be regarded as a representation by us or any other person that the objectives and plans set forth in this News Release will be achieved or be executed.

(This information is primarily sourced from UC Asset LP. Highly Capitalized has neither approved nor disapproved the contents of this news release. Read our Disclaimer here).